The Path to Financial Freedom is not a quick journey. Saving and investing sufficient money to become financially independent takes years of self-mastery and consistency. Let`s talk about persistency.

Persistency is a term that refers to the ability of a system or entity to maintain its state or behavior over time, even in the face of changing conditions or external factors. In general, the term can be used to describe any kind of persistence or durability, whether it be physical, emotional, or otherwise.

In the context of personal finance, persistency can be a key factor in achieving financial independence. Financial independence is the state of having enough income and assets to cover your living expenses without the need for active employment or assistance from others.

To achieve financial independence, it often requires consistent and persistent effort in managing finances, saving, and investing over time. This can involve making smart financial decisions, such as avoiding debt, living below your means, and investing in assets that can generate passive income, such as rental properties or dividend-paying stocks.

Persistency is also important in maintaining financial independence once it is achieved. This involves continuing to manage finances effectively and making smart decisions to protect and grow your assets over time.

So how to keep your motivation on the way to FI?

There can be different approaches. It is essential to keep in mind your WHY. The reason why you are pursuing financial independence and how you will spend your time after achieving FI. For example, if you want to spend more time with your family and work less – it can be useful to take a step back during a bad day and remind yourself of your WHY. Spend some quality time with your family during a vacation and gain back the motivation.

Sometimes it is necessary to take a complete break from FI. Especially if you are living frugally and don`t allow yourself to spend money on fun activities. Don`t make the mistake to be miserable on the path to FI, just to achieve it 1 or 2 years earlier. Taking some time off from saving can bring back your FIRE-spark and make the journey more enjoyable.

For me it is always helpful to split the whole journey into stages. My current FI date is July 2026. Around six years from my starting date in 2020. But this also means I`m halfway there. 3.25 years left. Or 40 months. Or 160 weeks. Or 1120 days.

Wait, only 40 months? That does not seem that much. Knowing how fast a month, a year can pass. And I even found a better way to measure my journey ahead. Using my WHY. I measure the journey in Travel. Before COVID I had a pact with myself to travel internationally at least once per month. And since travel has become more accessible again, I`m planning to take monthly vacations from the start of 2023. Which means my journey to FI is not 40 months. It is 40 Travels.

Sounds like fun. Travelling to 40 countries and then being financially free.

We have to see how the travel costs and dooming lifestyle inflation will impact my FI number & date. Maybe it will be pushed back a bit into the future. But that just means more travels, right? And what will I do anyway with my free time after FI? Move somewhere sunny and warm? I can do that now already!

Let`s dig into the Travel Tracker for a minute.

I split this into three sections.

- Pre-COVID

- COVID

- Post-COVID

Before COVID I was traveling a lot. As a combination of business travel and leisure, at least once per month to a different country internationally. It was the time when the idea of this „Travel“-Blog was born. Somewhere around October 2019 I started to learn about blogging, created my first word press site and wrote down ideas. Back then I wanted to focus on Solo Travel – the host name of this website „Whenalone“ is a relic from this age.

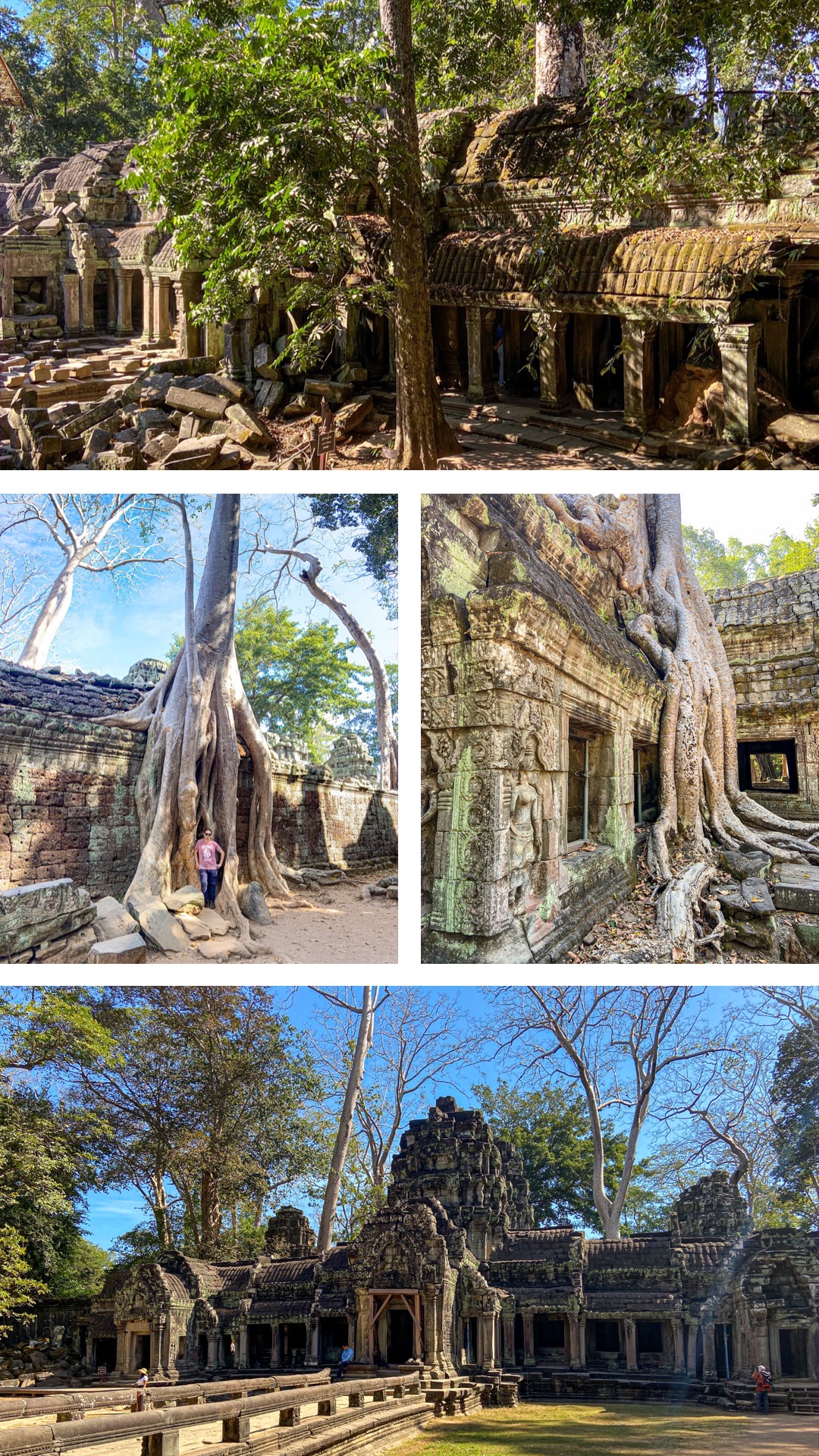

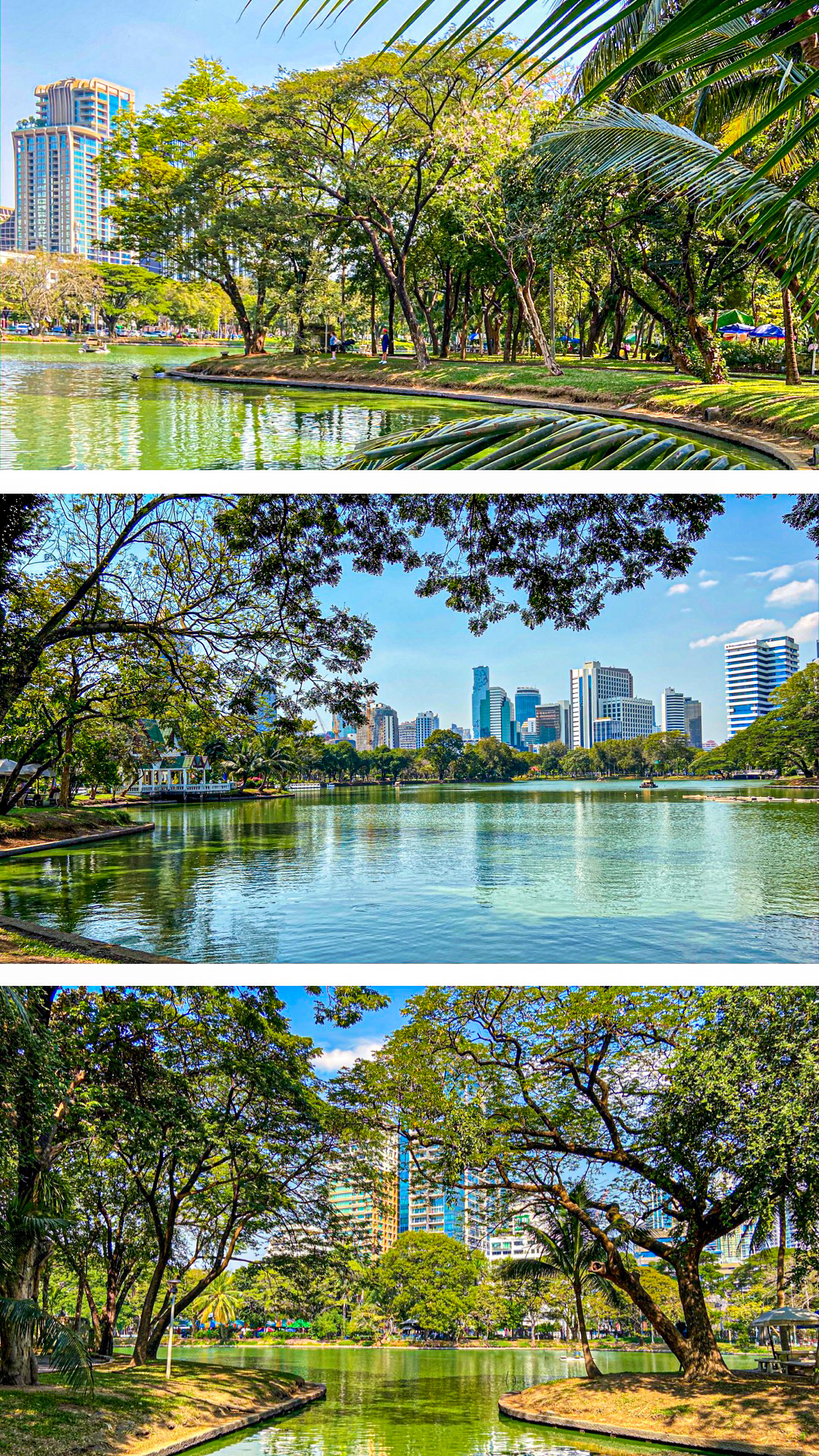

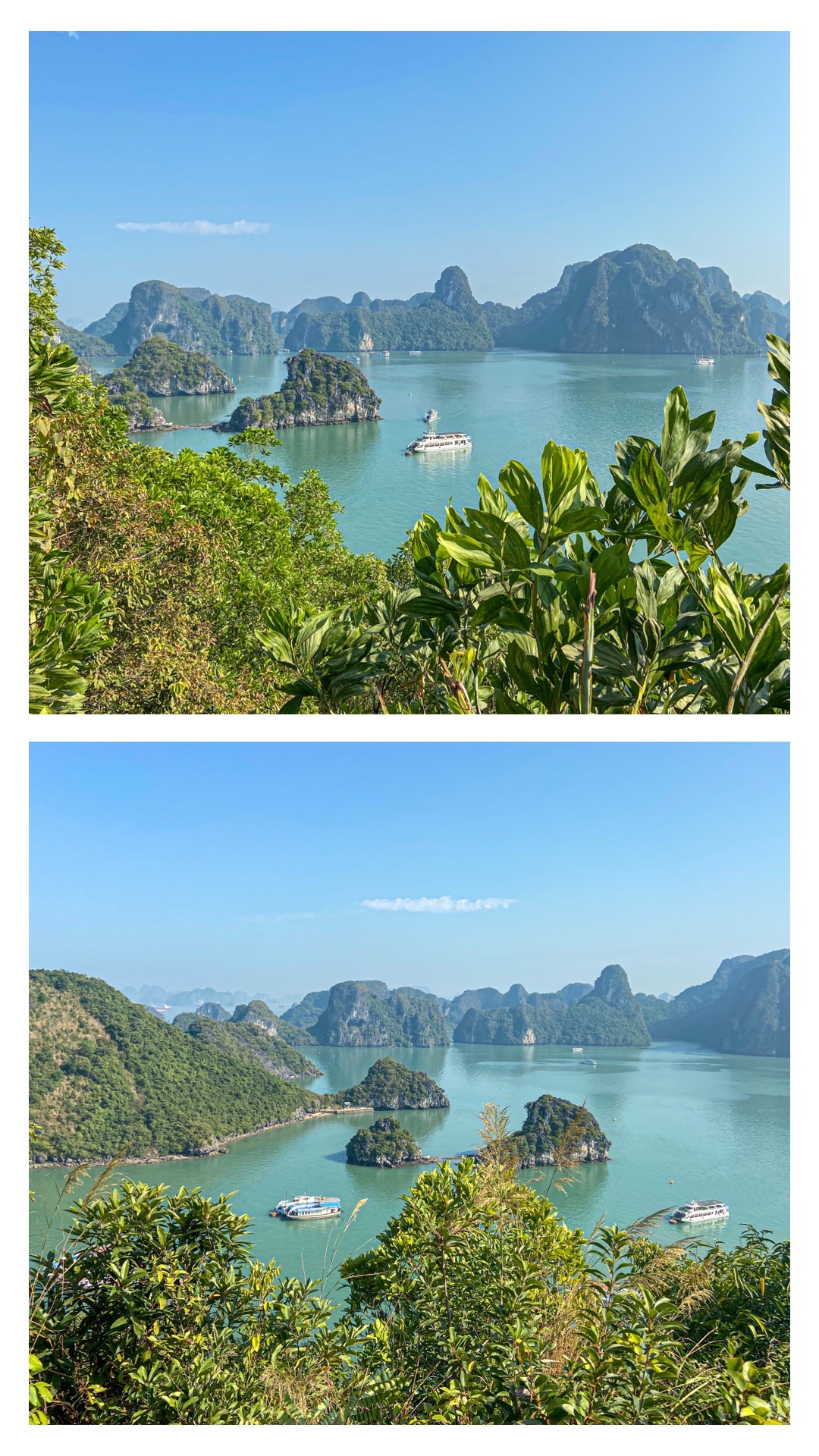

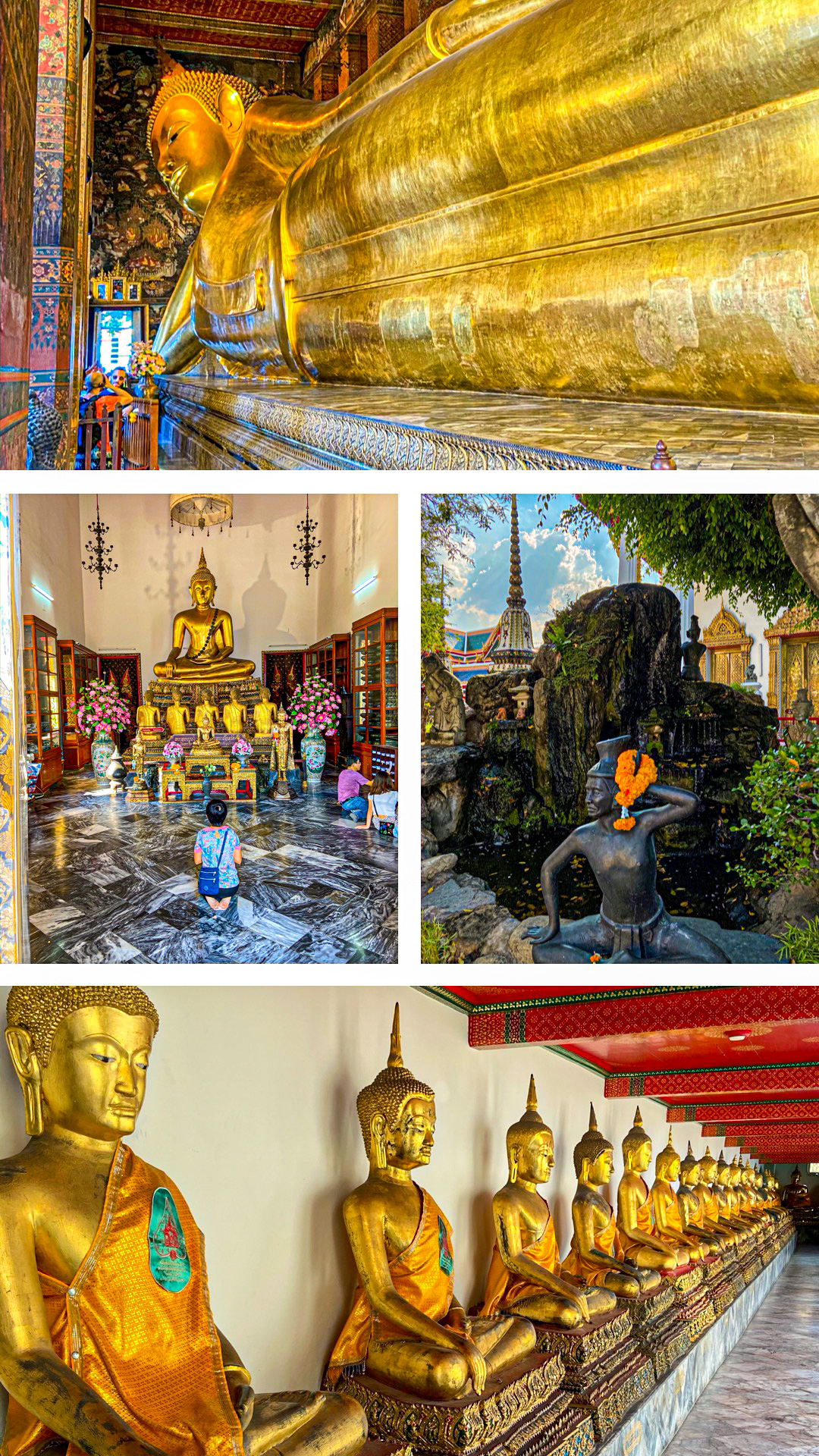

In 2019 I traveled across Europa (Malta, Hungary, Russia, Canary Islands, Croatia, Finland, Iceland, Latvia, Estonia, Poland, Netherlands, Switzerland) and made it to South America (Peru, Bolivia, Chile, Argentina, Brazil), the USA and South East Asia (Singapore, Indonesia, Vietnam, Cambodia, Thailand).

Probably I traveled more in one year than most people do in their whole life. And yet, my net worth increased from 20k to 32k in 2019.

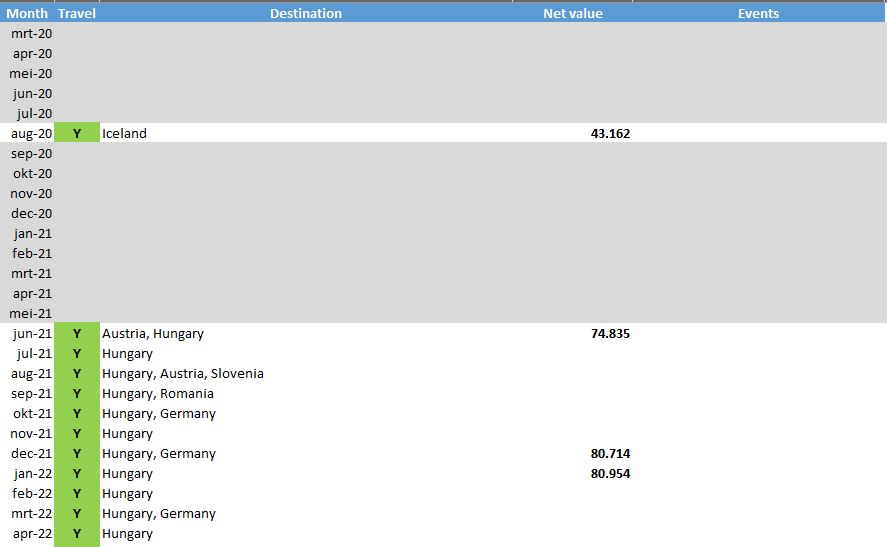

- Pre-COVID

I had planned ahead through the year 2020 to keep my monthly travel experience alive. Japan, Cuba, Oregon and many places in Europe. Then COVID hit and stopped the clock. Those are they grey months in below overview. My only travel was a three week escape to Iceland in August. Not surprisingly my net worth grew during the COVID time from 32k to 75k. There were just no options to spend money.

This was the time „FIRExplorer“ was born. I started a travel blog and then suddenly travel was dead. No one was even thinking about leaving their home. So what to do? I read a lot of FIRE books during quarantine times and then I thought….why not combine my travel passion with the pursuit of Financial Freedom? I already traveled the world extensively in 2019 and grew my net worth at the same time. Can I achieve Financial Independence while keep traveling across the world? Challenge Accepted.

2. COVID

The next year I spent with Slow Travel and relocating to different countries. First Hungary, then Netherlands. Even though COVID was still on the radar, I was able to do short distance travel. Like Romania, Slovenia, Austria. And I could fully explore the country and city I was living in. Not just spending a few days there. Saving money also gets easier during slow travel. A lot of synergies from living abroad in the same flat for a year and finding cheap places to eat around the city grow over time.

Now that COVID has disappeared (and until the next virus/variant hits), it is time to go back to full time travel. Starting from summer 2022 I made it to Copenhagen, London, Paris, New York City, San Francisco, Los Angeles, Barcelona, Mallorca, Budapest, Luxembourg and all across the Netherlands.

3. Post-COVID:

Monthly travel is back – my net worth is still growing. I just celebrated my First 100k USD. Let`s see how far I can make it this time. Next travel highlight will be Oregon and the Pacific North West in May. Luckily the costs are covered by my 13th and 14th month salary, so the impact on my FI date will be minimal.

Back to my FI date in 2026

3.25 years. 40 months. 160 weeks. 1120 days left. That is 40 more buckets to cross off from my list.

What`s on the list?

- Seattle/Portland/Vancouver (May 2023)

- South Africa

- Japan/South Korea

- Australia

- New Zealand

- Sri Lanka

- Hawaii

- Cuba

- Mexico

- Patagonia

- Colombia

- Canada

- Nepal

- Mongolia

- Rest of Europa (Scotland, Turkey, Greece, Norway, Sweden, Albania)

The only open question is what will happen first: Financial Freedom or checking of all countries from my list. Either way, it will be a wild journey.

So every time I lose motivation on the path to Financial Freedom, I remind myself:

Only 40 Travels left to Freedom!