1. Introduction

Meet Max and Moritz – Moritz is thirty years old, working as investment banker in London. Max is twenty-nine and a barista at Starbucks in Dublin. She sells ebooks online.

Moritz is making 70k net a year, Max earns 25k net from Starbucks and 10k online.

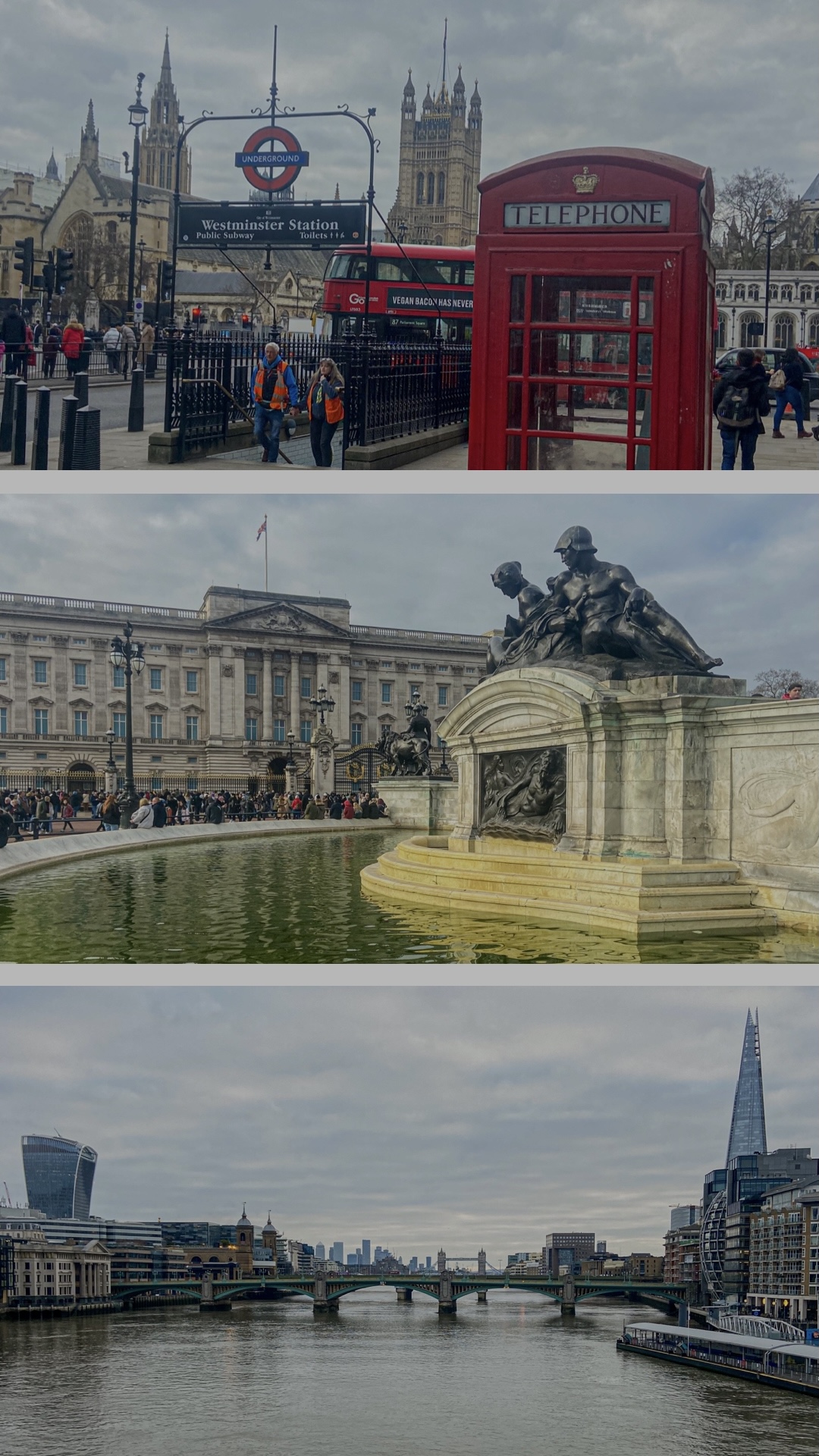

Moritz just bought a new flat in Canary Wharf. He doesn`t spend much time there, as most of is waking hours he is working from the glasstower next door. At least he can park his Porsche in the office garage, so he saves time looking for free parking spots at the street. Banking can be stressful and he is working long hours. He usually gets lunch and drinks at Starbucks downstairs. He dreams of traveling the world.

Here are Moritz annual expenses:

- Mortgage: 24k (2k per month)

- Car payments: 15k (1.2k per month)

- Starbucks: 6k (0.5k per month)

- Groceries: 6k (0.5k per month)

- Leisure: 12k (1k per month)

- Total: 63k

Max is living in a flat with her friend from university. Both of them studied English literature. Her friend already published her first novel. So Max feels a bit behind in life. She likes her colleagues at Starbucks and enjoys working there. Also coffee is free for her and she has become a master in bean roasting and coffee art. She is saving a lot. One day she will own a car. But where would she go with it anyway? Most of her free time Max spends with writing novels or reading. She dreams of traveling the world.

Here are Max annual expenses:

- Rent: 6k (0,5k per month)

- Public transport: 0.6k (0,05k per month)

- Starbucks: 0

- Groceries: 2k (0.2k per month)

- Leisure 4k (0.3k per month)

- Total: 12k

One day in August Moritz is on a business trip in Ireland and meets Max at Starbucks. Turns out they were both born in the same little town in England and went to the same school. They talk a bit about home and how they plan to see all the cool places around the world one day. „We just need to save up enough money and then we can go wherever we want, right?“ says Max. „Yes. One day.“ Moritz has to catch his flight back to London. They promise to stay in contact.

Who do you think will be able to go on this world trip first? Moritz, the successful banker from London or Max the barista from Dublin? Well, let`s look at their savings.

- Moritz savings: 20k

- Max savings: 150k

While Moritz was spending most of his high income on his cool flat in London, his Porsche and eating out every day, Max saved more than 50% of her income. She actually invested over 100k in her Vanguard brokerage account (which is managed by Moritz company) and her investment earnings are covering a good portion of her annual expenses.

Moritz will have to keep paying another decade for his flat and Porsche. By this time Max will already be living in Colombia, writing her third novel and casually sitting in her own coffeeshop in Bogota, roasting the best colombian coffee you ever tasted. Maybe Moritz will visit Bogota on a business trip one day and stumble into her coffeeshop. They can talk about their childhood memories again. Max will tell him about all the cool places she had visited in the past ten years. And Moritz will ask her, how she was able to save so much money?

Well, let`s start from the beginning…

2. The Basics of FI

It is not about how much money you earn, but how much money you keep. The key factor to financial independence is your savings rate:

- Income – Expenses = Savings

- Savings / Income = Savings Rate

Savings rate zero equals living paycheck to paycheck. You spend every cent you earn. As long as your savings rate is higher than zero, your net worth will increase. And the higher your savings rate, the faster you will reach financial independence.

Max has to save another 350k to become financially independent. (FI number 500k, current net worth 150k, annual income 35k, annual expenses 12k, annual savings 23k, savings rate 77%). The date will be influenced by her savings rate.

Let`s look at the different FI timelines for Max:

- Savings rate 10% – 3.5k p.a. – 100 years to FI

- Savings rate 30% – 10.5k p.a. – 33 years to FI

- Savings rate 50% – 17.5k p.a. – 20 years to FI

- Savings rate 66% – 23k p.a. – 15 years to FI

See how huge the impact of an increased savings rate can be to your FI date? If Max keeps her savings rate at the same level, she could retire at age 44. And this example does not include any additional income from investments (compound effect). After all, Max retired at 39 years.

As Max has done her homework early, she also invested most of her net worth into index funds which generated dividends and capital gains. We will get more into details of investments in Chapter V – Passive Income. For now let`s focus on the concept of compound interest.

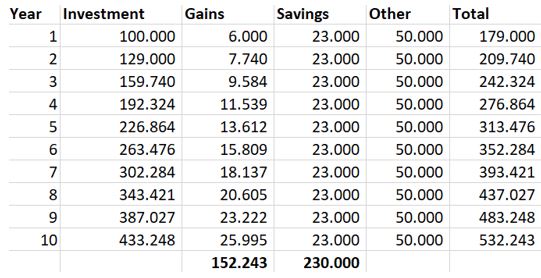

Max investment portfolio of 100k is generating dividends and capital gains of 6% per year. At the end of the year her investment portfolio has grown by 6k to 106k. Max adds her annual savings of 23k to the portfolio. In the second year the investment generate 6% again. Her portfolio is now 129k, generating 8k additional value. By year three it makes 9k, then 11, 14, 16, 18, 21, 23, 26.

In ten years Max saved 230k, but her net worth increased by a total of 380k. Max does earn more passive income from her portfolio than active income from her 9 to 5. Her total net worth has grown above 500k within ten years. Max is financially independent. Five years faster than the 15 years projected by her savings rate.

What is the accelerator in this equation? Compound interest. Actually Max was already lean FI in Year Five, when her portfolio income covered her annual expenses. But now that her portfolio generates 26k per year she can also move into her own flat and afford some luxuory travels from time to time. Staying at home can be boring when you don`t have to work for money anymore.

Long story short – compound interest is your best friend on the way to FI. Invest early. Invest as much as possible. And watch your money grow. But what if the stock markets goes down and I lose everything? Let`s answer this question in Chapter V.

3. The Expense Audit

The key for Max early retirement is her frugal lifestyle. She is spending a lot less money than Moritz. And Max can do that because she keeps track of her daily expenses. Max is Budgeting.

First step on the way to do a proper budget is to assess the Status Quo. I call it the Expense Audit. Writing down all my fixed expenses and daily purchases. Rent, car payments, Netflix, Spotify, Insurance, Starbucks coffee, Groceries, Donations, Fuel, Taxes, Car service, Plants, Books, Cinema tickets, Alcohol – everything.

How does my budget file look?

When I embarked on my FI journey I started an excel budget workbook. First I created a tab on my monthly expenses (groceries, fixed expenses, eating out, others like travel/clothes/books/plants etc.) and tracked those for couple of months. It gave me a good overview over what I spent each month and where I could cut expenses.

It took me a couple of months to get an overview of my actual monthly expenses. Not every expense is recurring. Some are monthly, quarterly or even annual. When I thought I had considered every single cent flowing out of my bank account, another unexpected event popped up. So my suggestion is to do this for at least six months, to have a clear picture of monthly expenses.

Once I was comfortable with my Status Quo budget – I cut everything non-essential. Everything except my flat, food and my dog. Everything! I cancelled all my streaming channels, did not spend any money on clothes, travel or leisure. Never went out to a restaurant or a concert. I had three payments running out of my bank account for the whole month. This was the bare minimum. Then I looked around and assessed the new Status Quo. And I started to add back what I missed. What I felt was essential to live a good life. Netflix, Spotify, Travel, Concerts, food for my Dog, Starbucks.

My monthly expenses went down from 2.500 EUR to 1.000 EUR. I cut 1.500 EUR out of my budget on things I did not even miss or value enough to get back. That`s why it is important to budget.

The evolution of the budget – The Playbook

As a second step I added a tab tracking my savings rate, comparing my income to my monthly expenses. I added a line for each bank account and investment portfolio so I could track the separate incomes/expenses. Each month got a separate column. At the bottom I have a sum for net worth. This tab gave me an overview where I will go within the year if I keep my current income to expense ratio.

Then I added another tab for next year. And the year after. Up to my official retirement date. My expected retirement date is 70. (I don`t expect it will be possible to legally retire earlier than 70 considering the current status of the state pensions. Also I work in a job that is not physically exhausting, so I could and would work longer than 65).

Assuming my salary income will never increase, but my portfolio will gain 6% p.a., the tab on age 70 prognoses my net worth with 5 million EUR. I don`t need that number to retire – currently my FI date is at age 40. But it was good to see this annual trend up to my legal retirement date to get confirmation that I`m on the right path.

My excel file is now called „Playbook“. I added some more information and details to keep track of. But the most important part is still my budget. I open it almost on a daily basis to keep track of every expense. It started to turn into a game updating the Playbook once I saw the impacts it has and the numbers started to increase.

Currently my playbook has following tabs:

- Playbook (Overview tab with my goals and general satisfaction ratings, long term plans)

- Calendar (tab with timelines and important dates in the upcoming year(s))

- Travel Tracker (listing of all my travels, countries visited and budgets, plans for travel after FI)

- Offer Tracker (tracker of all my interviews/offers with different companies, my latest market value for salary negotiation)

- Career Plan (Current status of career plan, strengths & development items, network)

- Pension (my current state pension and personal savings if I would retire today, projection for age 70)

- Monthly budget (monthly/daily overview of expense in each category, savings rate)

- Year 2020 – Year 2078 (separate annual tab with projected income vs expense ratio and net worth up to age 90)

4. The Latte Factor

The Latte Factor is a personal finance concept that refers to small, daily expenses that can add up over time. The term was popularized by personal finance expert David Bach in his book, „The Automatic Millionaire.“ The idea behind the Latte Factor is that by cutting out small, daily expenses such as coffee, snacks, or lunch, an individual can save a significant amount of money over time.

For example, if someone spends $5 on a latte every day, that’s $35 per week, or $1,820 per year. By cutting out this small expense, they could save a significant amount of money that could be used to pay off debt, invest, or save for the future.

It is a simple and effective way to help individuals take control of their finances and make small changes that can have a big impact over time. By being mindful of daily expenses and making simple changes, such as bringing a coffee from home or eating a packed lunch, individuals can save money and take control of their financial future.

The Latte Factor is a metaphor for everything that will hold you back on your way to FI. It was not by coincidence that I used Starbucks as a setting of Max and Moritz story. Every time I am traveling across the world I end up at Starbucks. Why? Because the have free wifi, power outlets and I know the products always taste the same. No matter if South America, India or Alaska. And the coffee is also highly overpriced. For one Starbucks visit I could drink ten coffees at home. Or I could invest 5 EUR into my portfolio. One Starbucks coffee per day, 1.825 EUR per year. Which will grow into 25.498 EUR within ten year if I keep going. Is my daily coffee worth 25k?

Again – the Latte Factor is a metaphor. It can be used for every single purchase you are planning to do. Take a moment to step back from the instant gratification the purchase will give you and calculate the opportunity cost of spending this money instead of investing it. And the time you have to spend doing your boring work to afford it. Is it worth it? Only then make a decision.

5. The Big Three

I have a good overview over my monthly expenses, but where do I start to save? I usually comes down to the Big Three – Housing, Transportation, Food. These are the areas you can save most, without big impacts on your quality of life.

House Hacking

There are multiple ways to reduce housing costs. Live at your parents, move together with your spouse or friends and share the rent, buy a house and pay it off, move to a low cost of living area or downsize your current appartment.

But you can also reduce your housing costs completely or even turn your housing into income. A famous concept is house hacking. Putting a down payment on a duplex housing unit, living in one part of the house and renting out the other part. Even if the rent does not cover the full mortgage, it is still way cheaper than renting. And once the mortgage is fully paid, your housing costs are down to zero and there is still a passive income stream from the rental unit. Which makes you almost instantly FI. We will get into real estate details in chapter V.

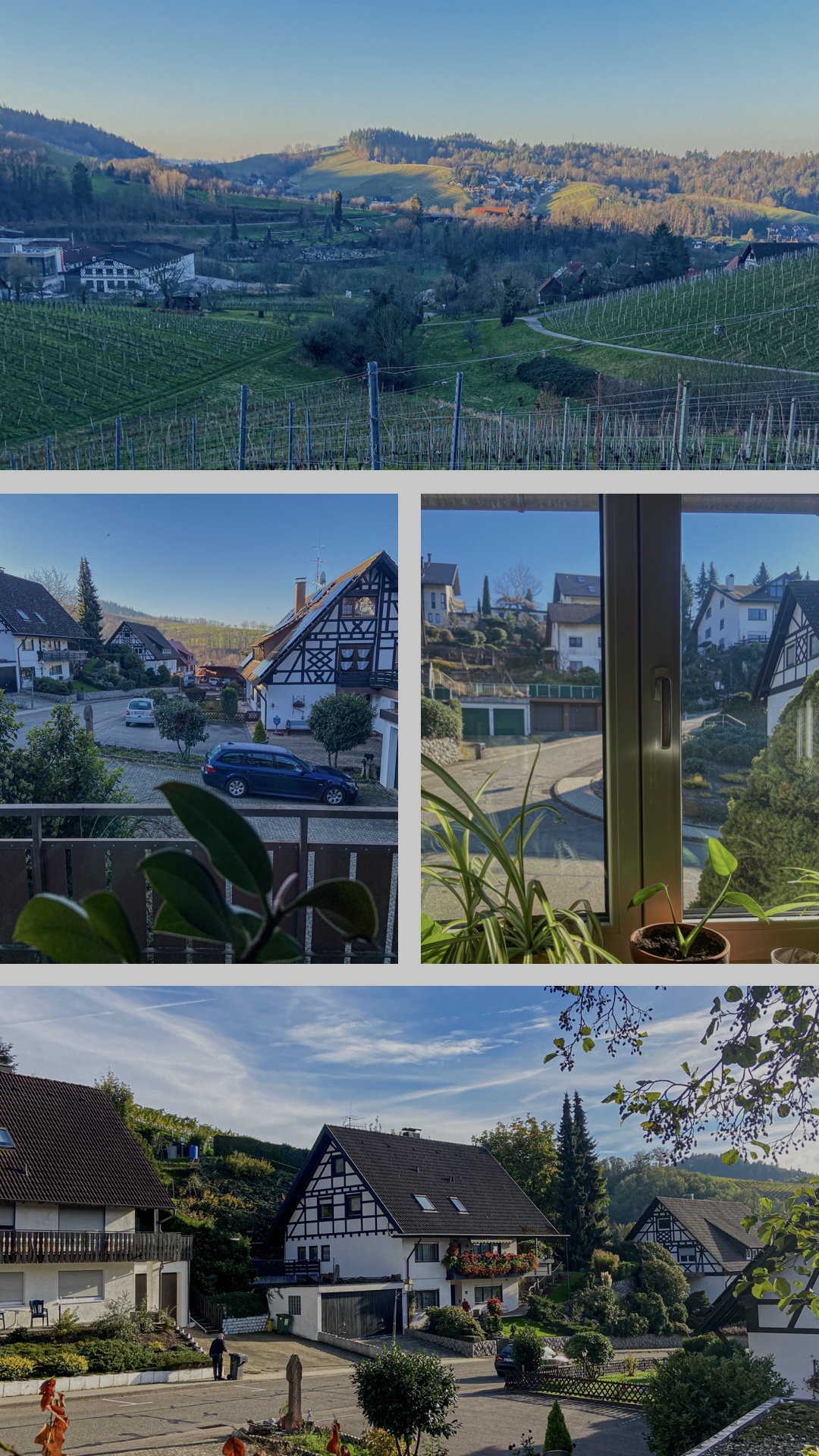

My FIRExplorer concept requires me to move around a lot. House hacking and real estate do not allow me enough flexibility to travel and work across the globe. I usually go with the option of housing below my means. I stayed a long time within my parents home. When I move, I usually pick a low cost of living area and a flat with maximum of 50 square meters. The golden rule is that your housing costs should not be higher than 30% of your income. It helps if your company is covering relcation and housing costs. We will get to the benefits of milking your 9 to 5 in chapter IV.

For now – just look at your current housing situation and expenses. Is there any option to decrease your monthly payments on housing?

Transportation Trap

There is a connection between housing and transportation. While you are still working and if you are not lucky enough to work fully remotely, you will need transportation to your office. The biggest waste of money is your car. Financing, taxes, insurance, fuel, depreciation, repair, time, traffic jams. I cannot even begin how bad owning a car is for your FI journey and life in general.

When you assess your housing expenses, definitely take the commute from your home to the office into consideration. I saved thousands by picking a flat in walking distance of my office or using public transportation. Many companies have benefits for using public transportation too.

In the unfortunate case that you actually need to own a car – buy a used car, pay it in cash and never pay more than 5k. Don`t fall under the charm of lifestyle inflation. Just because you can afford a Porsche, doesn`t mean you need to own it. It won`t make you happy for longer than three months.

Free Food

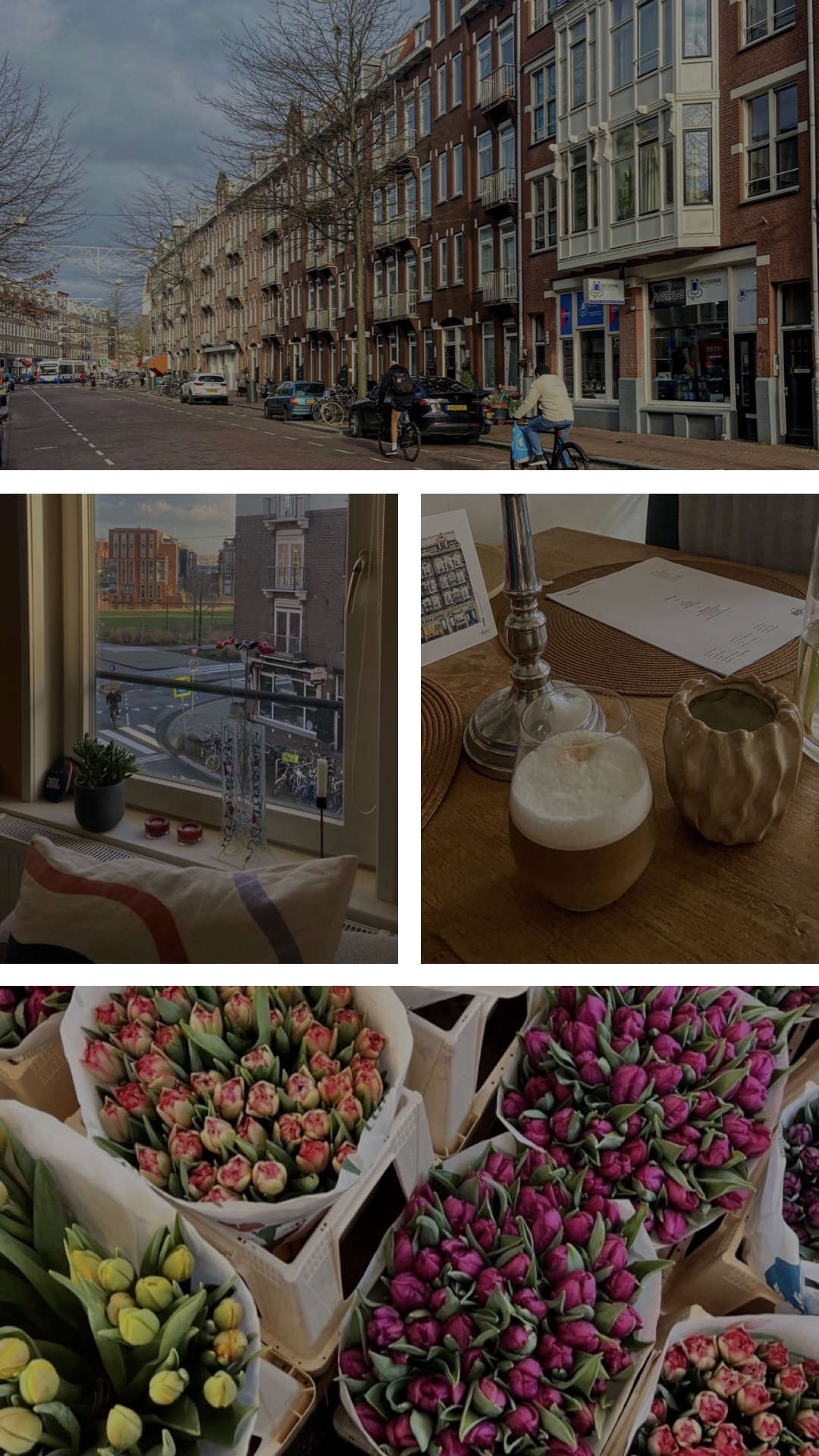

With inflation going through the roof, this one got even more crucial for your FI journey. Just an example: When I spend a Saturday in the city of Amsterdam with brunch, tea time and party night with cocktails I`m easily short of 50 to 100 EUR for food and beverages within 24 hours. Sometimes I do not even spend 100 EUR on groceries for a whole month in Amsterdam. Both is possible. Up to your choice.

Cooking your own meals is one of the easiest ways to reduce your expenses. Not only will you learn to cook the most delicious meals and eat more healthy, you will also save a great amount of money. Supermarkets usually have weekly rebate products. Most of the time you get 30-50% reductions or even two products for the price of one. You can plan your meal schedule around the rebate products. Turn grocery shopping and cooking into a fun game. Cook dinner for your girlfriend instead of taking her out to the five star restaurant. You definitely do not have to live from pasta with ketchup or bread and water every day to reduct your expenses on food.

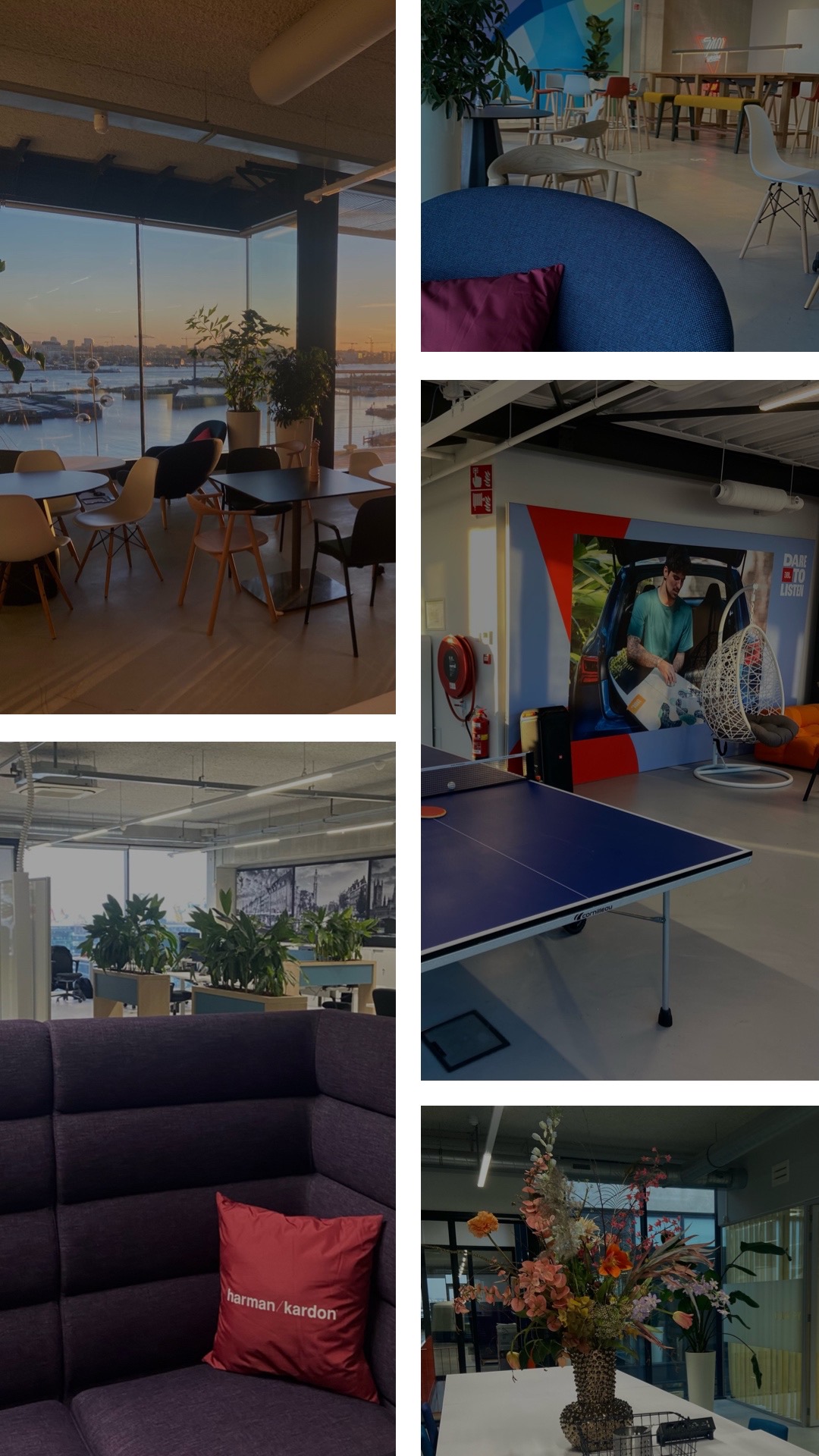

Even better, many employers offer free food and beverages for their employees in the office. If you are lucky enough to have a good coffee machine, free fruits and snacks you basically only need to do grocery shopping for the weekend. In Hungary I made it through some months with food & beverage expenses below 100 EUR. And I did not even cook during that time.

Now that you follow the Golden Rules of the Big Three,

- Maximum housing cost 30% of your income

- No transportation cost

- Reduced food & beverage spend

you see how easy it can be to get to a savings rate of 50% or above.

6. The Other Variables

We saved a lot of money at Housing, Transportation, Food and Coffee. Are there more options to max out the savings rate? There are various other variables that we could focus on here. I will go into more details of taxation and retirement savings in chapter VII. Just a few areas which can be easily adjusted without digging to deep:

Insurance – When was the last time you benchmarked your insurance provider? It can be easily done online, comparing your current insurance with the offer from competing companies. Even if you just save a few cents per month, over the full contract lifetime it can add up to more than just a few bucks. And after we learned about compound interest and the Latte Factor, we now know that even a few bucks can turn into a million if it just has enough time to grow. During year-end usually is a good time to check all fixed payments and contracts and see if there is a way to reduce the expense.

Entertainment – Do you like music? Concert tickets can be very expensive. Especially if it is a big artist and there is more demand than supply. If you are ok with missing the concert to save money, don`t buy tickets on the first or second market. There are many people that bought tickets which get confronted with reasons to cancel. Family dinner, work projects, out of town. You name it. And what will they do? Minimize the damage and sell the tickets below market value. I use Ticketswap to check on tickets of my favorite artists. If I get a cheap ticket, I`ll go. If not, I save the money and watch The 1975 concert on Amazon Prime.

Last but not least: Travel – Take it from someone who has been travelling on a monthly basis for years. You can waste so much money traveling. But you can also sav. Believe it or not, you can even get rich while traveling the world. That`s why I created Travel FI.

7. Travel FI

This is my favorite chapter in Part III – because it defines FIRExplorer. For many of you travel is part of your WHY. Once you finally don`t have to work for money anymore, you start traveling the world and see all the places you ever dreamed of, right? Well, what if you can combine your journey to financial freedom with traveling the world? Travel FI. You can actually use it to leverage your way to financial freedom traveling or living abroad.

Three concepts I want to focus on in this chaper are Geoarbitrage, Work Relocation & Travel Hacks.

Geoarbitrage is a financial strategy that involves living in a lower cost of living area while investing or conducting business in a higher cost of living area. The goal of geoarbitrage is to maximize savings and profits by taking advantage of the cost disparities between different regions.

For example, an individual who lives in a low-cost area like Southeast Asia but works remotely for a company based in a high-cost area like San Francisco can save a significant amount of money on housing and other expenses while still earning a high salary. This person can then use their savings to invest in real estate, stocks, or other assets that have the potential to appreciate in value over time.

I use Geoarbitrage locally and globally. If I move to a different city, I usually move into a low cost area within the city. If I pick a country to travel I prefer low cost countries. The sun in Mexico is just as hot as in California. And when I decide to relocate for my work, I pick cities not just by quality of living, but also by cost of living. Moving to a low cost of living country can even improve the timeline to FI. For example, in the Amsterdam I would need 1 million to retire comfortably. In Budapest I can do the same with 250k.

Another way to save money while travling is using Travel Hacks. Frequent flyer miles, credit card benefits, partnerships with brands and hotels. There is endless advice out there on travel hacks. I`ll leave it up to you to find out about it.

After I have seen most parts of the world and everything on my bucket list, I prefer slow travel. The best way to travel slowly is by living in the country for at least a year. And my favorite activity to explore different countries, cities and cultures is using work relocations.

Why work relocation? First of all most of the moving expenses are covered by the company. You are traveling and exploring a different country or city and it is basically free for the first couple of months. Some companies even help with finding a flat, moving costs, opening a bank account, language courses etc. And while you are exploring the new city, you are saving money on traveling that you would have done during that time anyway. Of course you are still working, but most of the time it feels like a big holiday. Once my saudade comes back I usually start planning for my next relocation.

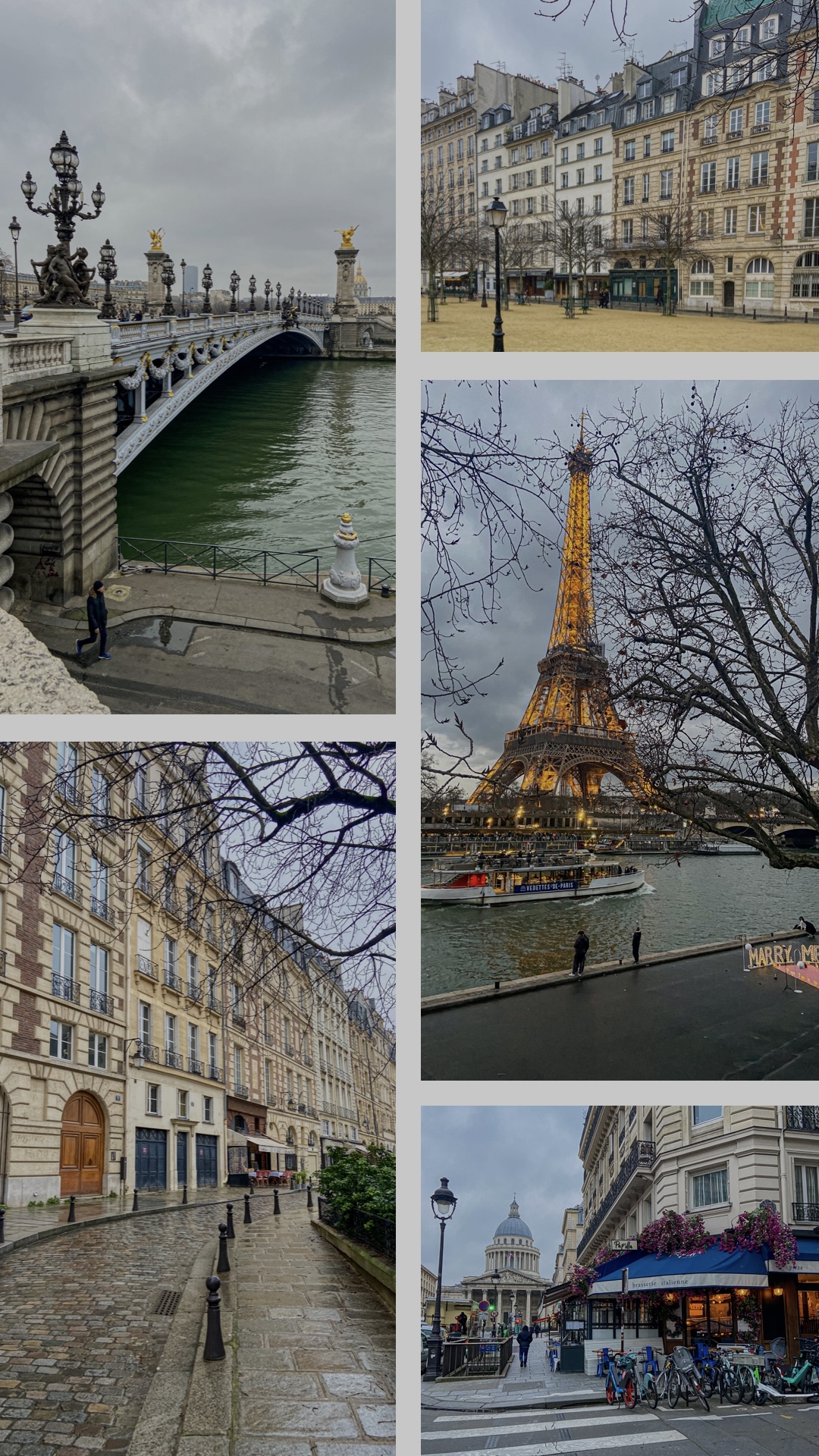

In the past two years I have move to Budapest and Amsterdam. Travelled across Austria, Hungary, Slovenia, Romania, Netherlands, Spain, Iceland, US. Visited London, Paris, Copenhagen, Barcelona, Los Angeles, New York City, San Francisco. All while working full time and growing my net worth.

That`s Travel FI aka getting rich traveling the world.

The FI Series:

- Part I – Stages of FI & FIRE Concept(s)

- Part II – WHY FI (How to Find your WHY and enjoy the journey to FI)

- Part III – Focus Point: Expenses (Spend less)

- Part IV – Focus Point: Income (Earn More)

- Part V – Focus Point: Passive Income (Invest)

- Part VI – Redefine Retirement aka Fully Funded Lifestyle Changes (Choose FI)

- Part VII – Other FI concepts in a nutshell (4% rule, compound interest, Mini-Retirement, Geo-Arbitrage, EU vs. US FIRE)

- Part VIII – The Best Books & Blogs on FIRE

- Part IX – FIRExplorer (Fight the Corpiarchy and leverage your job to Financial Freedom)

(In chapter IV we focus on the other side of our savings equation: Increasing income)