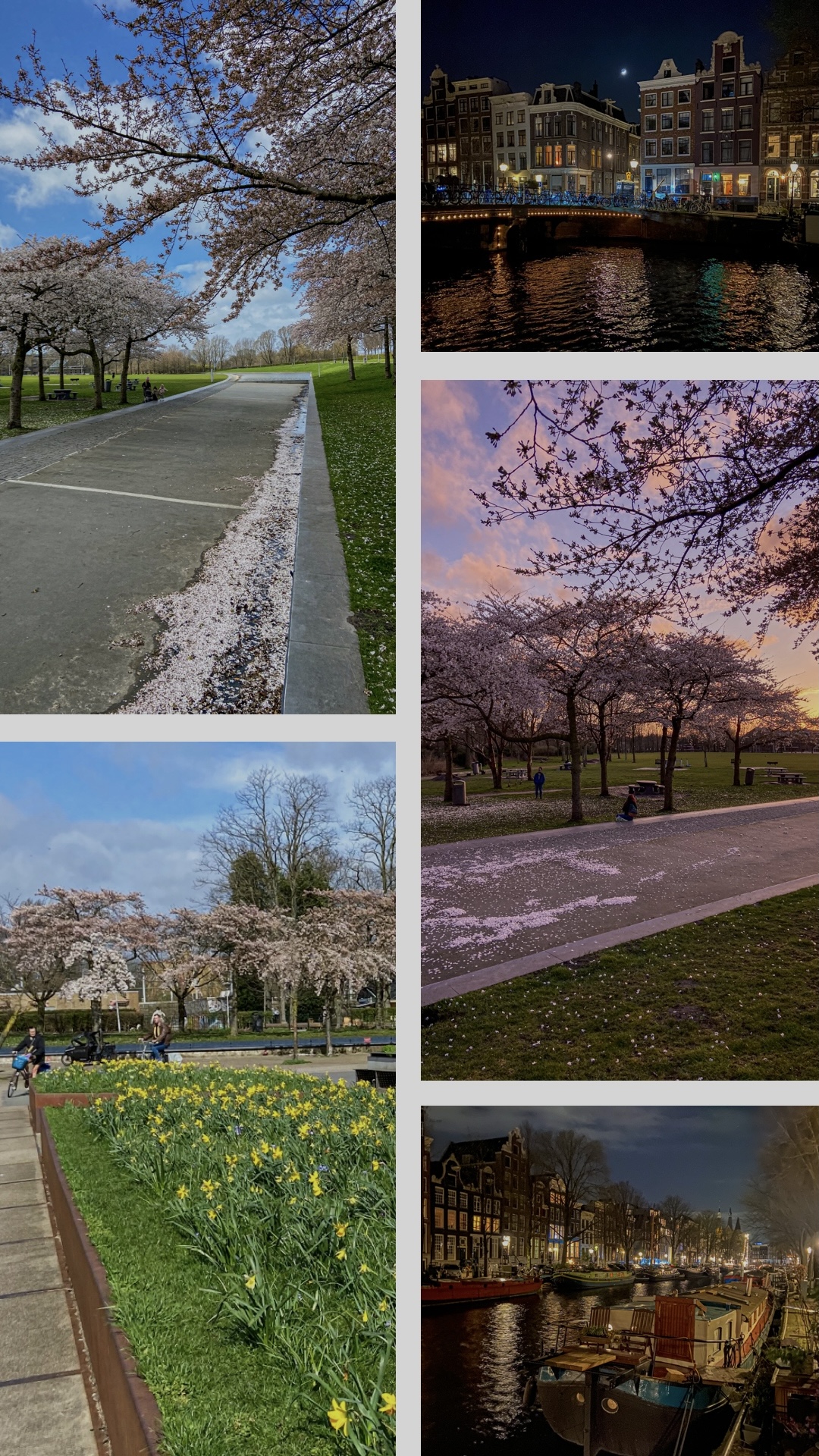

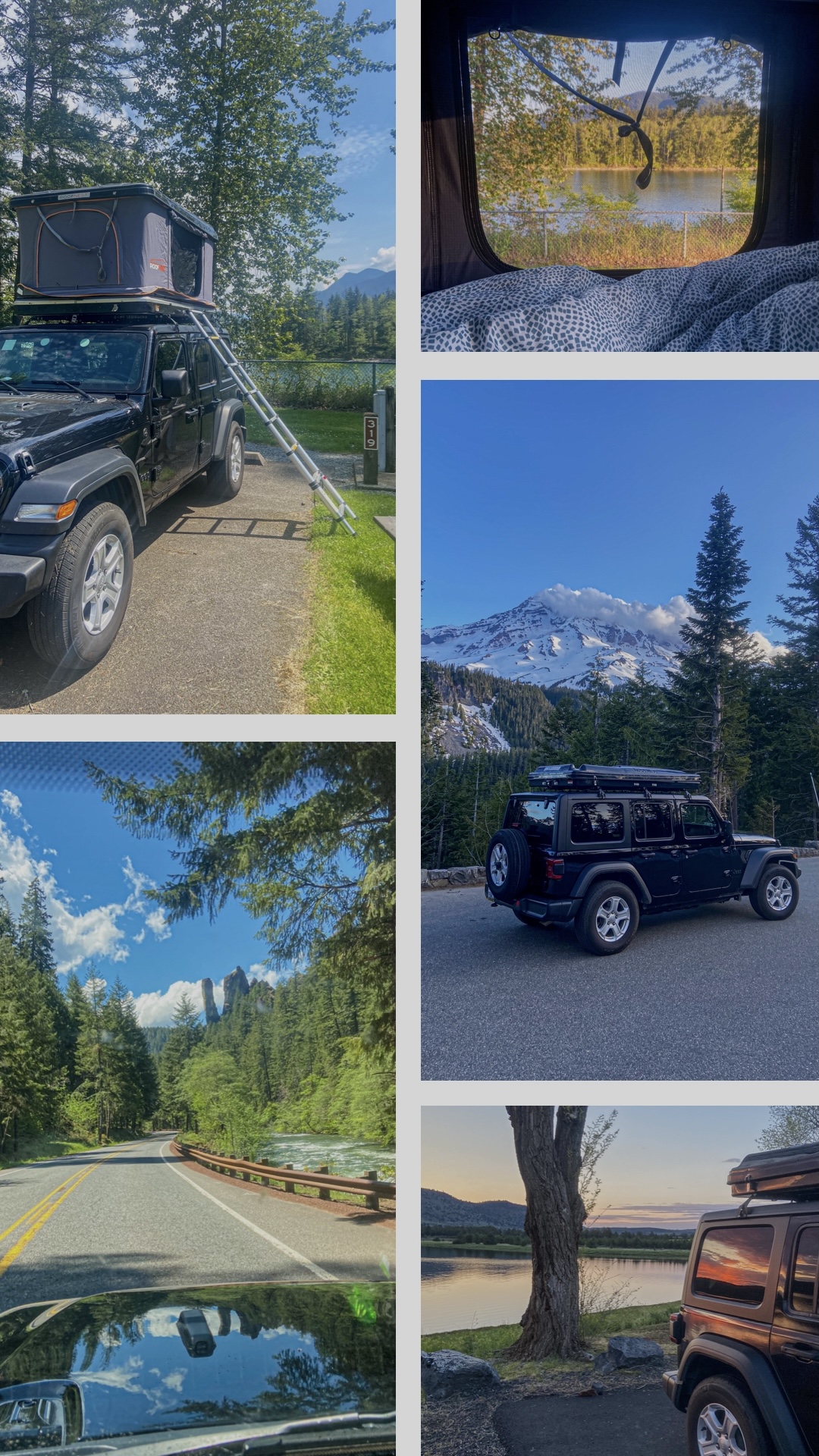

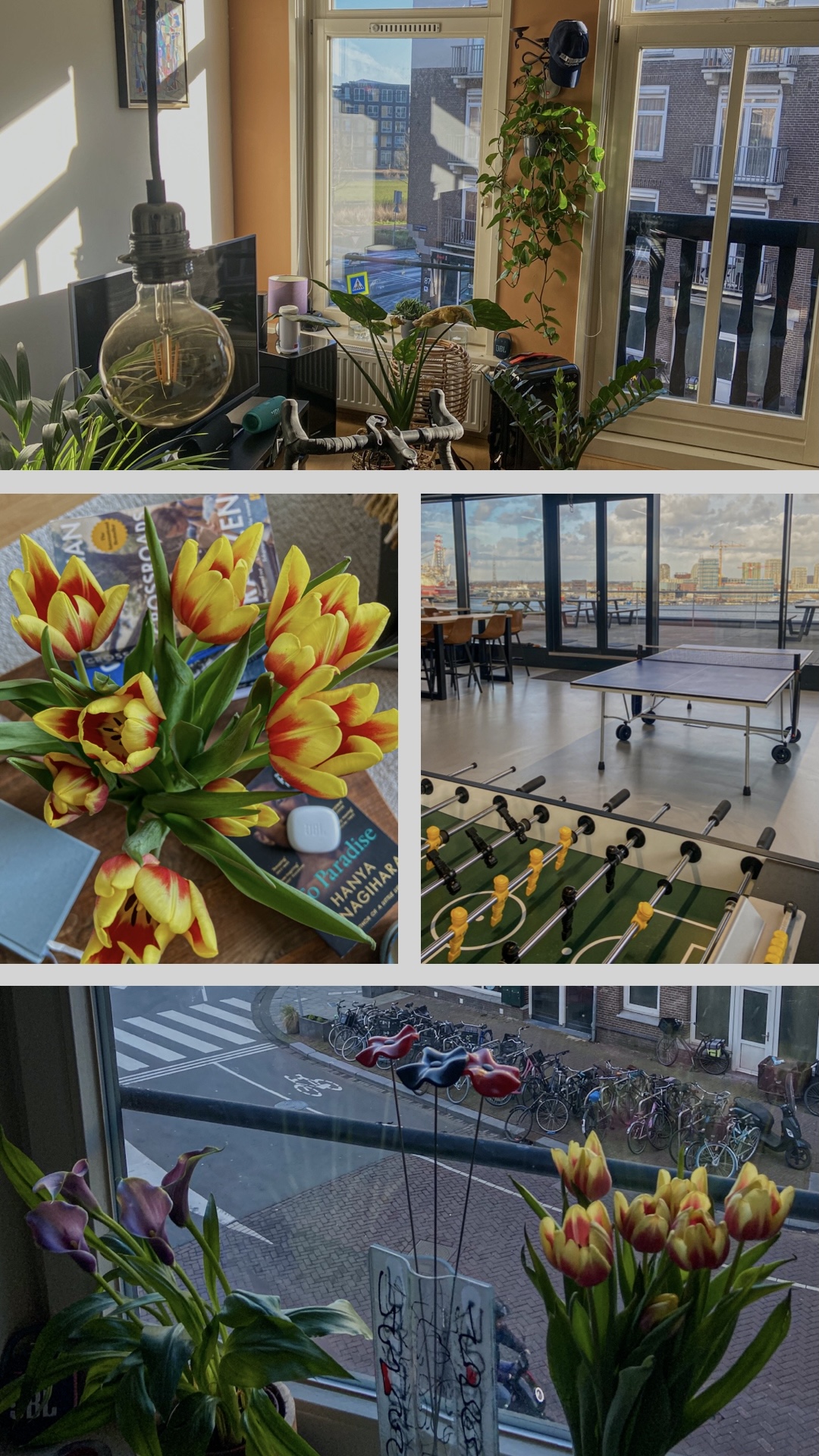

…apologies for 3 month radio silence. I was celebrating my first 100K and road-tripping through Oregon…

1. Introduction

Back to Max and Moritz. It`s Tuesday morning. 8:20. Max just unlocked the main door of the Starbucks and the first customer enters. It is always the same customer. Her best friend from middle school. The first ten minutes of each day are quiet. Because Starbucks only officially opens at 8:30. So they have ten minutes to chat while the machines are heating up. Her friend just had a baby and this is the main topic of their daily conversation. But not today. Today the talked about teenage memories.

“Do you remember when we dropped out of school and back-packed the country for half a year? That was the best time”

“The best time. But then it was back to reality. It took me three years to finally finish school. And I was dead broke all the time”

After Max dropped out of school she went through a couple of rebel years. Parties, drugs and alcohol. Once she was back on track she graduated from evening school working full time at a restaurant and bar. When she finally made it to university she was already 23. And she kept on working during her studies. Which meant no time for friends, family and hobbies. But also getting her degree without any student debt. Moritz went to a private university in London, studied Business Economics and graduated at 23 with 150.000 pounds in debt. He paid off his student debt until 35, which is one of the reason he has not saved a penny since.

And while Moritz was living out his party time during university, Max has already graduated from her party era and started her own little business. Her sparse free time after the lectures and work she spent on her passion: Writing. After realizing she could sell her stories and guides online she started to set up a website and a blog. Her e-books are now generating 500 pounds of passive income every month. Not enough to survive. So she continues to work as barista at Starbucks. That is where Max and Moritz ran into each other again.

Max now has four additional income streams next to her salary at Starbucks:

- E-book sales on Amazon

- Affiliate marketing income from her travel blog

- Online & weekend barista courses

- Passive income from her investment portfolio

Moritz never started a side hustle. But he was very successful in increasing his active income. From starting salary 32k he worked himself through promotions and job changes up to 120k in five years. He used his additional income on lifestyle upgrades, not to pay off his student debt.

Let`s take a look at Max and Moritz income sources over the past ten years.

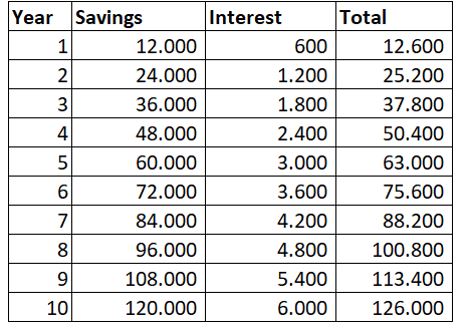

Moritz:

- Income:

- Net salary: 5.000 per month

- Bonus: 1.000 per month

- Total: 6.000 per month

- Expenses: 5.000 per month

- Savings: 1.000 per month

- Net worth: 12*1.000 = 12.000 * 10 years = 120.000 minus student loan 150.000 = -30.000

Max:

- Income:

- Net salary Starbucks: 1.500 per month

- E-books sales: 500 per month

- Total: 2.000 per month

- Expenses: 1.000

- Savings: 1.000 per month

- Net worth: 12* 1.000 = 12.000 * 1,05 * 10 years = 126.000

Even though Max nets a lower monthly income, both of them have the same amount of monthly savings and her net worth after ten years is significantly higher. Part of it is the impact we discussed in Chapter 3 – The Compound Effect of Investments. But there are other factors at play which we need to include into consideration:

- Education opportunity costs – Is your student loan worth it?

- The profession choice – Do I need to study to earn enough to become FI?

- Active Income Optimization – How to get the most value out of your 9to5

- Multiple Income Sources – Setting up a side hustle and creating multiple/passive income streams

Let`s start with…

2. Education (EU vs US FI)

Student loans

Student loans are a form of financial aid that are designed to help students pay for higher education, including tuition, fees, and living expenses. In many cases, students and their families may not be able to afford the full cost of a college education, and student loans can help bridge the gap.

There are two main types of student loans: federal and private. Federal student loans are issued by the government and offer certain benefits, such as fixed interest rates and flexible repayment plans. Private student loans are issued by private lenders, such as banks or credit unions, and may offer different terms and conditions depending on the lender.

Repaying student loans can be a significant financial burden for many borrowers. Federal student loans offer several different repayment plans, including income-driven repayment plans that base monthly payments on a borrower’s income and family size. Private student loans may have different repayment options, depending on the lender.

Student loan vs free education in Europe

Luckily in Europe education costs are way lower compared to the US. During my studies in Germany I did not pay any fees for university. But even if you go to a private univserity with good reputation, you will never reach the same amount of fees as you would pay for the same studies in the US. And let`s be honest, once you started working no one gives a shit about where you studied.

While all the US graduates are paying off their debt for years after graduation, in Europe you can start investing your work income from the first day. This is a huge advantage to Financial Independence, which the higher salaries in the US can never make up over time. So if you are lucky enough to be born in Europe – Congratulations. For the US readers I will refer to more detailed resources in the appendix.

But stop – why waste five years of investing with university when you can get a job right after high school? If I start investing with 20, won`t I reach FI earlier than if I start investing with 25? Well, it depends.

College vs. Work (The College Decision Tree)

A very helpful tool I discovered in a book about financial independence „Choose FI“ is the College Decision Tree.

„If you already made the college decision, are in a highly paid career you`re satisfied with, have no college debt, and don`t have kis to help navigate these decisions you can skip this chapter. If you`ve finished college and are in a rewarding career, but school loans are handicapping your ability to save toward a FI lifestyle, you`ll need to determined the optimal strategy to handle your loans so you can move forward etc.“

If you fit into these categories, you will have a different decision tree. You should question the assumption that college is right for everyone. You get the drill – check out the whole tree in „Choose FI“ from Chris Mamula, Brad Barrett and Jonathan Mendonsa (btw their podcast is amazing too)

Hack College

And if the decision tree decided for you that college is the best option – you need to treat college as an investment. Don`t waste time and money going to the most prestigious college. In the daily work life no one cares where you went to college or how large you student loans are. Only your work output gets noted.

„The best hires were people that worked in high school and college and had that experience. Because college can give you some skills, but it doesn`t teach you communication skills. It doesn`t teach you on the job problem-solving skills. And in pretty much every career, those are the two things that separate the successful from the not successful.“

Remember the stories of Max and Moritz? Which one do you think was more successful in hacking college?

There is a large list of advice on student loans, scholarships and college hacks out there. I`ll leave this section to all the US-FI bloggers.

3. Milk your 9 to 5

I`m officially working a 9 to 5 now – and I hate it. How do I get out of here?

If you are reading this, you are most likely stuck in a job that you don`t like or at least you have some ideas how to spend your time in a more meaningful way. If this is not you – you are very lucky. Enjoy your dream job while it lasts. This chapter may still have some useful tipps for you.

How to increase income (Treat your career as an investment)

Your best friend on the path to Financial Independence is your work. Because it provides you with all the necessary input to retire early successfully. Treat your career as your most important investment, and nothing can stop you on your way to become financially free.

How do I treat my career as investment?

Just like any investment, first of all your put down money. This is your education, your studies, your degree. Based on your degree and accumulated learning over the years, your will gain returns. In form of your annual salary and benefits. It is not passive income, like investing into an index fund and collecting your dividends each quarter. It is active income from work. But it just works the same. The more you invest into your career, the higher the gains.

If you are satisfied with your current income and do not want to grow it, just do what is required. If you want to grow your income, you have to increase your input. Getting a higher degree, working for a promotion, taking a second job, building up a side hustle, etc.

All of these gains compose over time, just like your investment account composes over time. And the compound interest from your career will reduce time to FI.

Promotion (Manage your organization)

The very first idea that comes to mind when brainstorming how to increase your active income from your career is a promotion. It usually comes with a base salary increase of at least 10% and additional benefits depending on your level (for example bonus, car allowance, stock options etc.).

But there is a trade off. The increased salary usually also comes with an increase in responsibility, working hours and stress. If your focus is on improving your work-life balance and creating a life for early retirement, the promotion may actually have a negative impact on your quality of life. And the slightly increase timeline to FI does not fully compensate for this. So what other options are there to get the most out of my 9to5?

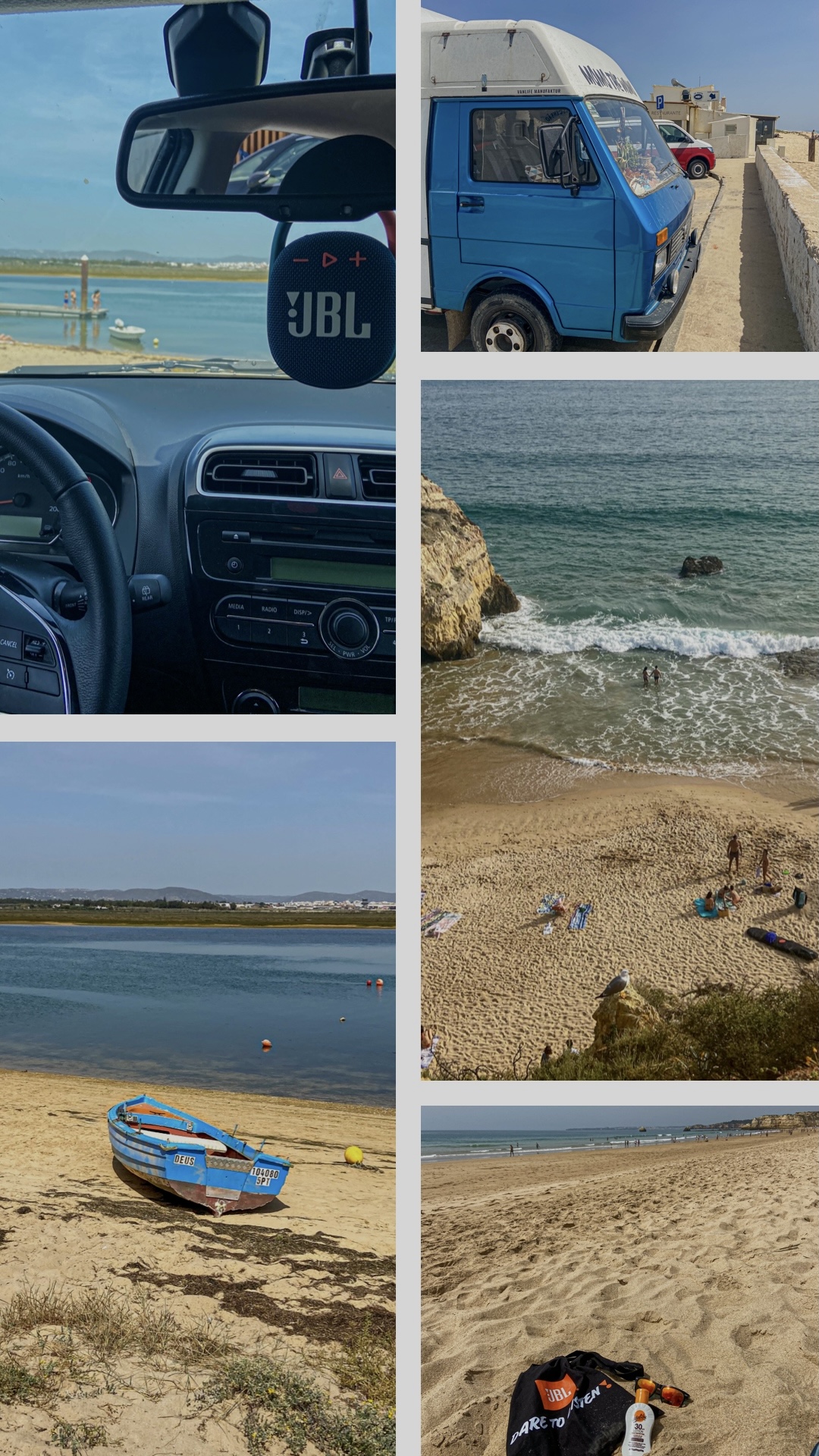

Travel / Education budget

I used to work in a position that required me to travel on a monthly basis. Required? Or let`s say allowed. Because not only is your travel fully reimbursed, you usually get a meal allowance and free weekends too. Some months I was traveling across the globe and did not spend one cent of my salary. So if you enjoy traveling, find a position or career that allows you to be on regular work travels and enjoy your time exploring new countries and cultures.

Another option is to use educational budget to develop your skills. Most companies have programs and policies in place that allow you to fully reimburse certification costs and exams, if those are related to your current position. Of course you cannot expense a language course if you are working in finance, but there are many learning costs that can be covered by your employer and which will help you develop your skilsl for the future.

Best case is to find courses that are still related to your current job, but more focused on where you want to go in the future. Don`t be afraid to use the educational budget, even if you are planning to leave the employer soon. You are just a number on a spreadsheet, and so are they on ours.

Free lunch or other benefits / Company Events

Let`s take it even further. While many of us are working from home most time of the week, there is one office perk that should not be forgotten. Free food and drinks. Usually coffee, soft drinks and fruits are free for taking in the offices. Some companies even offer free or partially-free lunch. This may not reflect on your monthly paycheck in your net salary, but it reflects on your day to day expenses. And as we all remember, the biggest driver on the way to financial freedom are our monthly/annual expenses. Another company might offer you 5k more gross salary, but after including all benefits like free lunch, travel and educational budget plus taxes, you might end up worse than before.

Not to forget company events. Summer party. Christmas party. Pub quiz. Friday afternoon drinks on the rooftop. It is not just a perfect opportunity to network and make new connections, it it also a great way to save some money and indirectly increase your work income. Take a look back to your most recent year at work. How much money did you save while attending company events, reimbursing expenses or drinking office coffee instead of Starbucks? The options to milk your 9to5 are endless, but you have to take advantage of those.

Use higher income to invest (no lifestyle inflation)

Now we increased our income thanks to the latest promotion and let our employer pay most of our day to day expenses. Finally time to buy some new clothes for the next Christmas event, right? Well, all of the benefits above are worthless if you spend your increase income on unnecessary stuff. Your paycheck increase from 3k to 5k. Of course you will spend more money. And you get used to it.

So next time it increases to 6k, you will spend even more money. It is called lifestyle inflation. Keeping up with the Joneses. But just because you earn more, does not mean you have to spend more. Instead, try to put every additional cent you earned from the above tipps into your investment account. That`s how you treat you career as an investment and turn your 9to5 into passive income.

4. Take advantage of the Corpiarchy

Your colleagues at work are not your friends and your company is not your family. If you disagree with this statement, you will probably learn a hard lesson one day. But for now, let`s just assume this statement is true. Taking emotions out of your work life equation and focussing on the professional part can help you grow your income significantly. Here are a couple of ideas how you can use your actual 9to5 on the path to freedom and speed up your journey.

Strategically job hop

The best way to increase your salary and market value is to change positions regularly. The hiring budget is usually higher than the retention or promotion budget. So to increase your salary consistently you will need to move positions, departments, companies or even industries strategically. This does not mean moving to new opportunity every year. Job hoppers still have a bad reputation with hiring managers and recruiters. If you don`t stay longer than a year in the position, why would they invest into you? You probably would not invest into yourself either.

The sweet spot is usually 3-5 years. This is the time you are not new to the position anymore and your learning curve flattens. If you stay too long in one position it will not only impact your financial opportunities, but also your development and potential for growth. But changing positions only 3 to 5 years is not the best option to maximize your salary. So how to move without being a job hopper? Move internally.

Internal moves

You can move more frequently within one company. It is less likely to be considered as job hopper if you move through three positions within three years within one company, than if you move through three different companies. It just looks more consistent on your CV. And you also build up a better network within your company if you move through different roles and departments. This does not have to be a promotion. Lateral moves with salary increase can be your best option to maximize your market value.

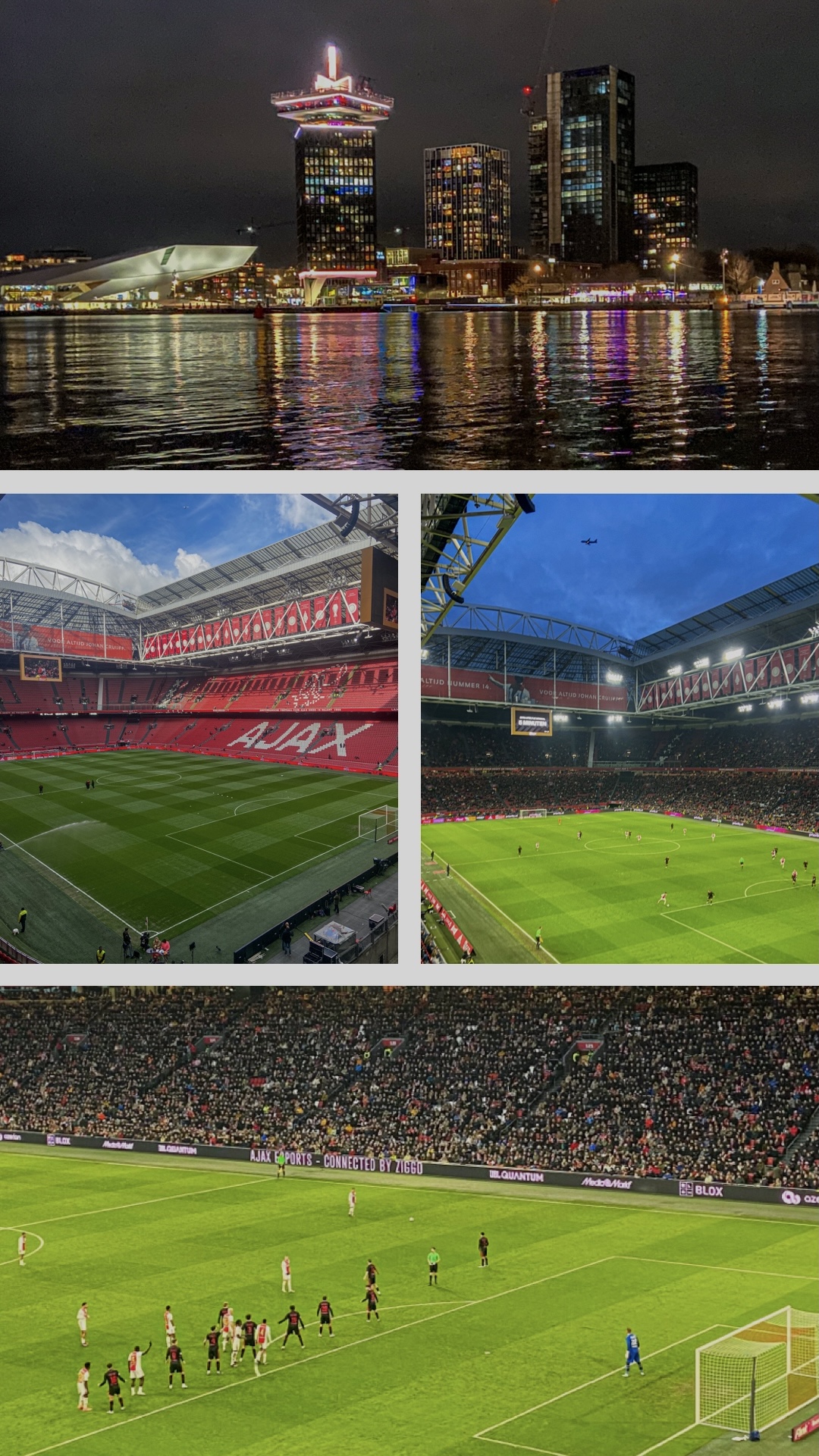

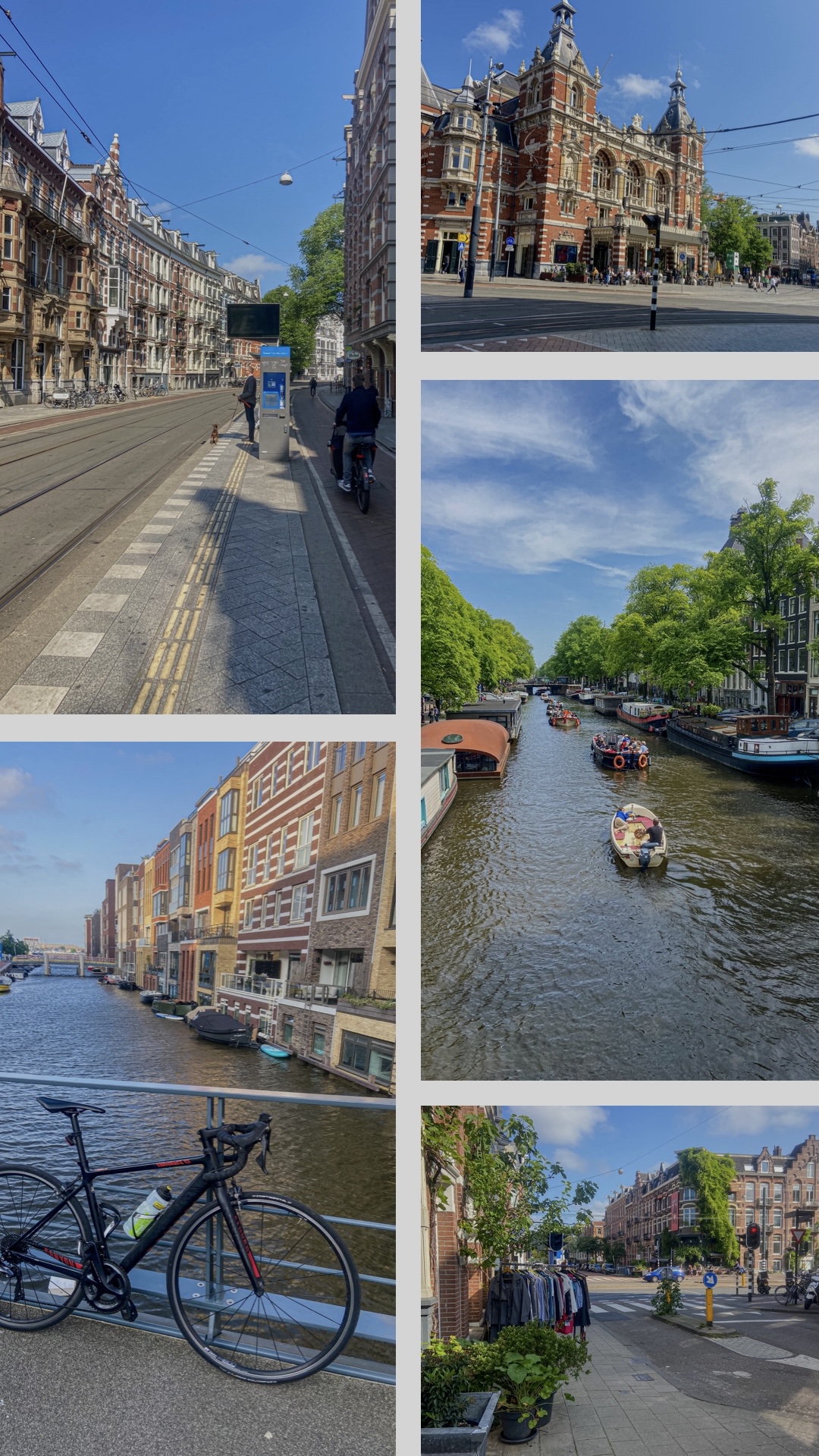

Not only will you gain additional skills, but you can also use your higher salary in future negotiations with other companies. If you are flexible enough, you can max out your potential by moving to different locations of the company which offer the highest salary (such as Germany, Netherlands, Switzerland, USA). Which brings us to our next option.

Relocation

Moving to a different location of your company can not only increase your salary, but also have additional positive effects on your FI journey. Many companies do support relocations financially. By paying for your moving costs, having a budget for buying furniture or even covering part of your rent. Especially in the first couple of months of the relocation your costs are lower than if you would have moved by yourself. Combined with potential salary increase this can have significant impact on your FI journey.

If you are relocating to high cost of living country, the delta of your net salary to cost of living, your monthly savings, is greater than your delta was in previous location. Combined with other benefits, like the 30% tax ruling in the Netherlands or pension payments, your timeline to FI gets shorter. Remember, your FI date is mainly impacted by your expected expenses during retirement.

Earning income in a high cost of living country and retiring in a country with lower cost of living is the fastest way to FI. And smart work relocations are a perfect tool for it. Additionally you get to explore different countries and cultures, broaden your horizon, learn new languages and make friends all over the world. And it opens you up for new opportunities in other countries.

Partial freedom generates opportunities

With every move you gain an additional portion of freedom. Your FI date came closer, your market value is higher for salary negotiations and you have a broad set of skills and intercultural knowledge. You can use this partial freedom to further speed up your way to FI.

Because the freedom you gained allows you to take more risks. Invest more time into your side hustles. Interview for other opportunities and negotiate higher salaries. Or just reduce your working time and enjoy life. Remember, your company is not your overlord. It is your customer. You offer your services in exchange for money and other benefits.

If the exchange does not benefit you anymore, you find another customer who offers you better benefits. You even may be able to play with your opportunities and optimize your quality of life. Turn your 9to5 into a game.

Negotiate your way to FI

And once you get bored of moving to other countries or you found a place to settle down, you can use your increase salary and freedom to negotiate. The best time to negotiate your salary is when applying for new opportunities and accepting offers from other companies.

Your salary is not the only means for negotiation. Most companies have fixed budgets for roles, which don`t leave room for negotiation. But you can negotiate other benefits which can also impact your journey to FI. Here are couple of money-equivalent and non-monetary benefits to negotiate during the interview process:

- Health insurance

- Pension

- Part time

- Vacation days

- Flexible working hours

- Working from home / Working remotely

- Relocation support

- Starting bonus

- Starting date

All of these factors can have an impact on your work-life balance and indirectly or directly on your FI date. Therefore it is always important to consider the full picture of a job offer before accepting and negotiating the best option. Remember – what you negotiate at this position will be your basis for future negotiations with other employers. It enables you additional freedom points in The Game.

5. Networking

Networking is the process of building and maintaining professional relationships with people in your industry or field. It can involve attending industry events, connecting with people online, or simply reaching out to individuals with similar interests or backgrounds.

Networking is important for a number of reasons, including:

- Opportunities for additional income: Networking can help you uncover new job opportunities or freelance work, which can help you earn additional income outside of your primary job. This can be a key part of achieving financial independence by diversifying your income streams.

- Learning about new investment opportunities: Through networking, you may learn about new investment opportunities or strategies that can help you grow your wealth and reach your financial goals more quickly.

- Access to mentors and advisors: Networking can connect you with experienced professionals who can offer guidance and advice on financial planning, investing, and other key aspects of achieving financial independence.

- Collaboration and partnership opportunities: By connecting with other like-minded individuals, you may be able to identify opportunities for collaboration or partnership that can help you grow your business or investments more effectively.

- Improved financial literacy: Through networking, you can learn from other professionals about financial planning, investing, and other topics related to achieving financial independence. This can help you improve your financial literacy and make more informed decisions about your money.

To effectively network, it’s important to be proactive and strategic in your approach. This may involve identifying key individuals or organizations that you’d like to connect with, reaching out to them through email or social media, or attending industry events or conferences where you can meet new people and expand your network.

When networking, it’s also important to be authentic and genuine in your interactions, and to focus on building long-term relationships rather than just seeking immediate opportunities or benefits. By investing time and effort in building a strong professional network, you can create valuable connections and opportunities that can benefit you throughout your career or business.

Find mentors

How to find mentors? I would start at work. Most companies offer mentorship programs where you can participant as a mentor or mentee. Those are usually temporary programs for six months or a year. Taking on new mentors and staying in contact with your old ones will help you build up a network within your company. Keeping in touch even after you move positions or to a different company is how you improve your potential for future opportunities.

Mentors should usually be someone in a position you would like to move to in the future. For example if you want to take over a team lead or department lead role, you should find a mentor who is working in similar position so they can help and guide your development into the right direction.

Build a network outside of profession

But focusing on having mentors at work or within your profession will not help you to expand your horizon and develop areas where you can build up side hustles or a business idea. It is also a good idea to diversify your portfolio – meaning collecting mentors with different viewpoints than your own. It can be useful to find a mentor in an area that you want to grow you business in.

For example if you are interested in selling and shipping self made products online, find someone who has built up a successful online business and connect. If you want to write a book, get in touch with other authors during book conventions. Or reach out to fellow FI enthusiast and join the Global FI network.

FI-Network

One of the coolest network out there is the FI network. Why? Because it is like minded people with the same dreams and goals than you (at least I expect that since you are reading this book). It is a pretty diverse network from all around the world, all groups of ages and ethnicity.

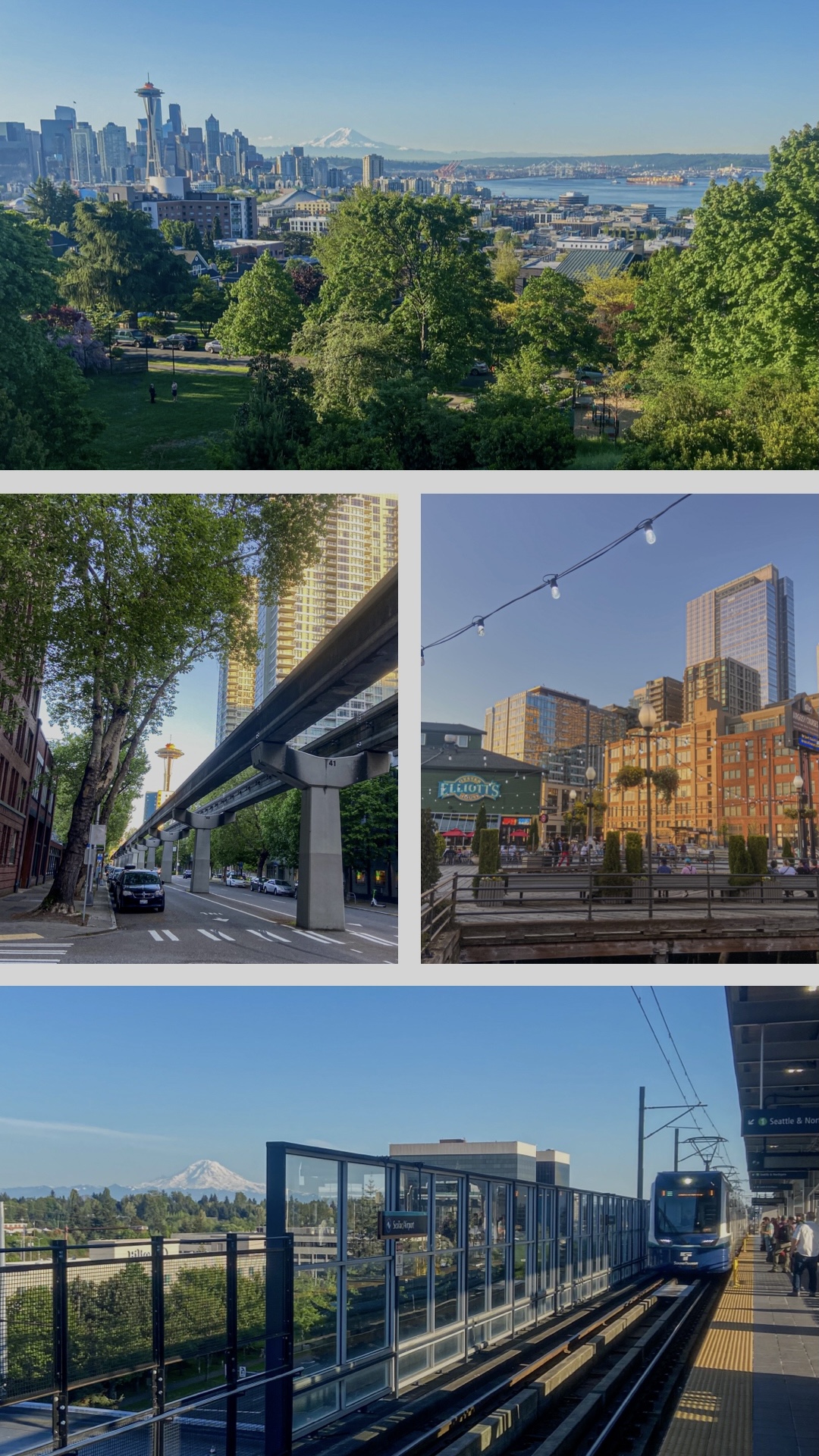

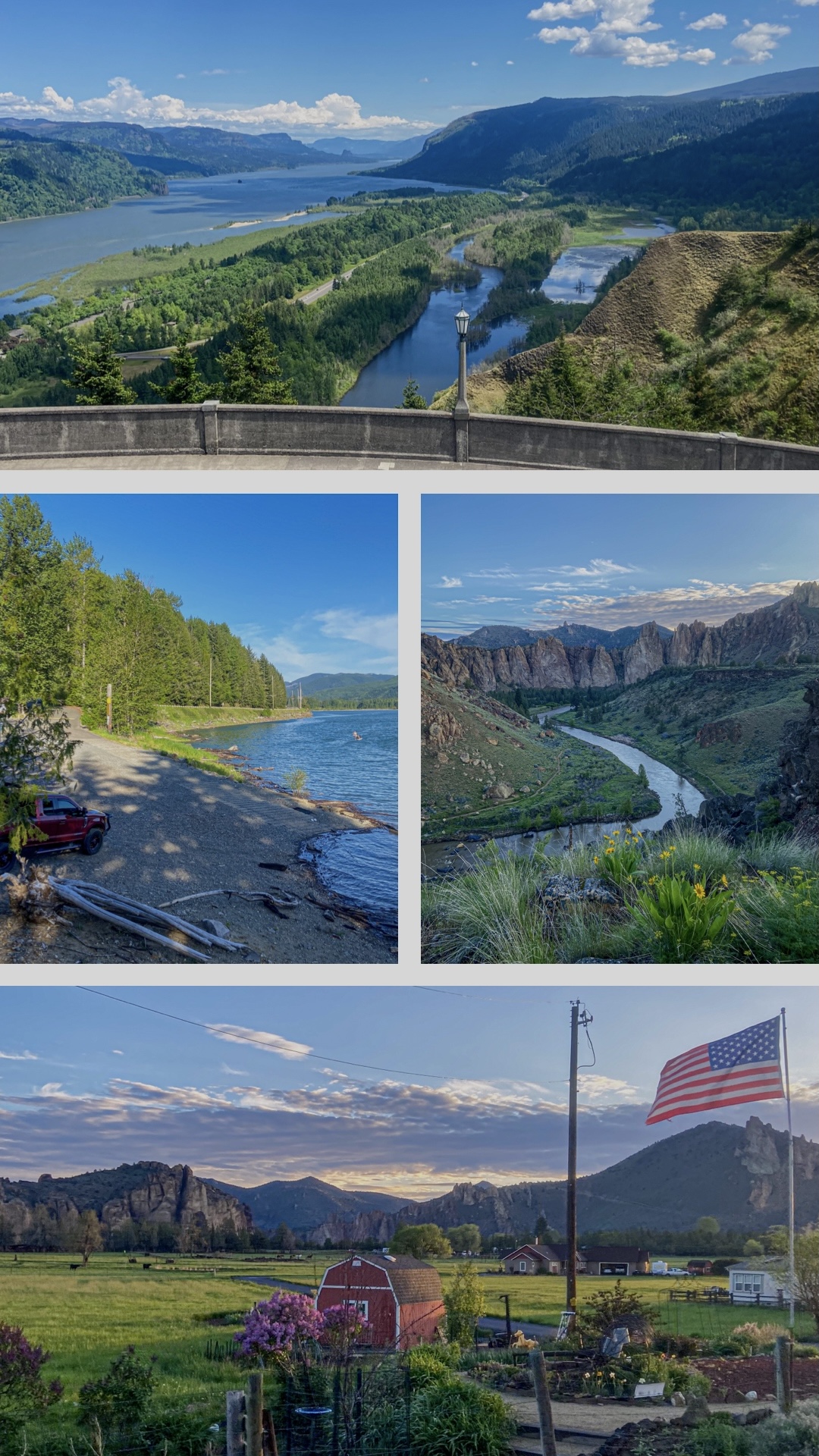

Let me tell you a story of my first in-person FI meetup. For years I was planning to do a road trip through the Pacific North West of the US. Washington, Oregon, Seattle, Portland, Bend. Few days before my flight to Seattle was schedule I came across a Facebook invitation from the Fioneers to their first ever in-person meetup. And it was supposed to be in Portland, Oregon.

At the same time I had my road trip around Portland schedule. What a coincidence. So one sunny Wednesday evening I found myself sitting in a cider pub on the outskirts of Portland talking to ten other FI enthusiasts from the area. And this was just the starting point. There are numerous events all around the globe. CampFI. EconoMe. FI Retreats. Just to name a few.

6. Side Hustles

A side hustle refers to a type of work that someone engages in outside of their primary job or career to earn additional income. This could include freelance work, part-time work, starting a small business, or any other type of work that can be done in addition to one’s primary job.

Side hustles have become increasingly popular in recent years, as people look for ways to supplement their income or pursue a passion project. The rise of the gig economy and the availability of online platforms and marketplaces have made it easier than ever to start a side hustle.

Side hustles can provide a number of benefits, including additional income, the opportunity to pursue a passion or interest, and the ability to develop new skills and experiences. However, it’s important to consider the potential impact of a side hustle on one’s primary job and to ensure that any additional work doesn’t interfere with job performance or violate any company policies.

Work on passion next to 9to5

If you are already working in your passion job, then you would not consider a side hustle and instead try to maximize your income from your passion job. So let`s assume you are multipassionate and would like to turn one of your passions into an income source. Best piece of advice I can give is not to jump head first into your side hustle and invest all your time and money into it. It is called „side“ hustle for a reason. But to first go into the water with one toe, then one foot etc.

Your side hustle will most likely fail. That`s just the nature of it. It takes consistent tries to find the perfect business idea and grow your side hustle into a successful and profitable business. And it takes time. A lot of time. But if you don`t start it will take forever. First step – figure out which areas you want to explore with your side hustle. Then think about what skills are missing to get you there.

Aquire new skills

Let`s say you would like to become a travel blogger, but you are working in marketing. Sure, there are some knowledge, like creative writing or SEO marketing that you can use from your day to day profession. But most of the skills for your side hustle you have to acquire. And there is no university degree to become a travel blogger. So how to learn new skills?

For me it was most helpful to observe others who already did what I wanted to do. Search for blogs on the internet and see what makes those successful. How many articles did they have to write until the blog got attention. What is the typical lenght of a blog post. Which topics are addressed. What forms of online marketing are those blogs using? How are they growing their readership through social media?

There are many online courses out there, specifically for skills that they don`t teach you at high school or university. But those come with a price and you never know how useful these are. Most of the information on the internet is free. So my suggestion is to start looking for free (advertisement driven) channels. Youtube videos. Online blogs. Social Media posts. TikTok videos. And then start use your newly acquired skills to build up your first side hustle. Most experience will come from trial and error.

I will dedicate a separate chapter on side hustles and step by step guidances, including options to create passive income out of your side hustle. But now we take a look at the other option.

Use professional knowledge to leverage into side hustles

In above mentioned example of someone working in marketing trying to create a travel blog lies a huge advantages. You can use all your knowledge and resources you gain at work and leverage into your side hustle. Like all those engineers and coders at Google who create their own app, selling it for millions.

- You can re-think ideas at work to assess if this is something to share with your employer or patent for yourself into a side hustle.

- You can use your work network as leverage for your side hustle.

- You can use your education budget at work for your side hustle.

- You can take over additional projects at work to develop your skills for your side hustle.

- You can use down time at work for creating your side hustle.

- You can use your monthly salary as investment into your side hustle.

- You can use your work travels as inspiration to create your travel blog.

- Or use your struggles with work politics to write articles about mental health and work-life balance.

Again – the options are endless. You just have to recognize and own these opportunities to create your own little world out of it. Once your have build up a successful side hustle – you turn it into passive income. Rinse, Repeat.

7. Passive Income

Passive income is a type of income that is earned with little to no active involvement or effort on the part of the recipient. This could include income from rental properties, dividend-paying stocks, interest earned on savings accounts or other investments, and any other type of income that does not require active participation.

Passive income is often seen as a way to earn money while minimizing the amount of time and effort required. However, it’s important to note that many types of passive income still require some level of initial investment, whether it’s in the form of time, money, or other resources.

Examples of passive income include:

- Rental income from properties or real estate investments.

- Dividend payments from stocks or mutual funds.

- Interest earned from savings accounts or other investments.

- Royalties from creative works, such as books, music, or videos.

- Affiliate marketing income from promoting products or services online.

Passive income can be a great way to supplement your income, build wealth over time, and achieve financial independence. However, it’s important to carefully consider the potential risks and rewards of any investment, and to do your due diligence before investing in any particular asset or opportunity.

We will get into details on passive income sources in Chapter V – Passive Income / Invest. But before closing Chapter IV, let`s look at another potential passive income source that is not frequently talked about. Your 9to5.

Bonus chapter: Transform your 9 to 5 into passive income

Did you ever ask yourself how many hours per week you actually spend on concentrated work? Wrote down your working hours per week and noticed you may only need 20 hours to complete your 40 hour work tasks? If so, this chapter is for you.

A 40 hour work per week position is tailored for an average worker. Half of the employee will struggle doing all work in 40 hours, the other half will finish in less than 40 hours. You are in the second bucket. You finish your tasks in four hours per day instead of eight. What do you do? Play ping pong with your work colleagues. Take additional coffee breaks. Scroll through the internet. Do some online shopping. Take over additional tasks from others to finally get promoted. Pretend to be busy. Either way. You are wasting time.

Because what you did with finishing your working in 20 hours per week instead of 40 hours, was just turning your work into passive income. You are working actively for 20 hours. But you are getting paid for 40 hours. So half of your salary is passive income. And if you understand the concept, you can use it for your gain. Maybe there are some more tasks that can be accelerated or automatized, that you just have not looked into yet, because you did not see any gain in it. But what if you can reduce your active working hours down to 10 hours per week? Now 75% of your salary is passive income.

And all that additional time gained you can use to invest into yourself. For example your side hustle. Or working a second job. Believe me, you are not the first one to discover this concept. Did you read one of these articles about remote workers doing two to three full time positions simultaneously, earning triple salaries? I guess they knew how to turn their 9to5 into passive income. So what is stopping you from it?

The FI Series:

- Part I – Stages of FI & FIRE Concept(s)

- Part II – WHY FI (How to Find your WHY and enjoy the journey to FI)

- Part III – Focus Point: Expenses (Spend less)

- Part IV – Focus Point: Income (Earn More)

- Part V – Focus Point: Passive Income (Invest)

- Part VI – Redefine Retirement aka Fully Funded Lifestyle Changes (Choose FI)

- Part VII – Other FI concepts in a nutshell (4% rule, compound interest, Mini-Retirement, Geo-Arbitrage, EU vs. US FIRE)

- Part VIII – The Best Books & Blogs on FIRE

- Part IX – FIRExplorer (Fight the Corpiarchy and leverage your job to Financial Freedom)