As there is a lot going on I decided to split the annual updated into two parts – Second part of Year 3. This annual update has been titled „The First 100k“ by me in advance. My excel spreadsheet prognosed me to reach this milestone mid of 2022. What could have been an smooth journey turned into an epic battle. A battle that could not be won. But sometimes you have to lose a battle, to win the Great War.

All that bloodshed crimson clover, sweet dream was over

2022 threw everything at me what it had in store: Double-Digit Inflation Rates, Global Supply Chain Crisis, War in Europe, Endless Bear Markets at the Stock Exchange and Cryptos, Declining FX Rates, Dictators, New Covid Lockdowns, Narcissists, Farewells, Broken Hearts and another Work Relocation. I have cancelled my Netflix account, because for three years now there is no movie or show that could keep up with reality. So we are down for another turbulent annual recap.

From sprinklers splashes to fireplace ashes

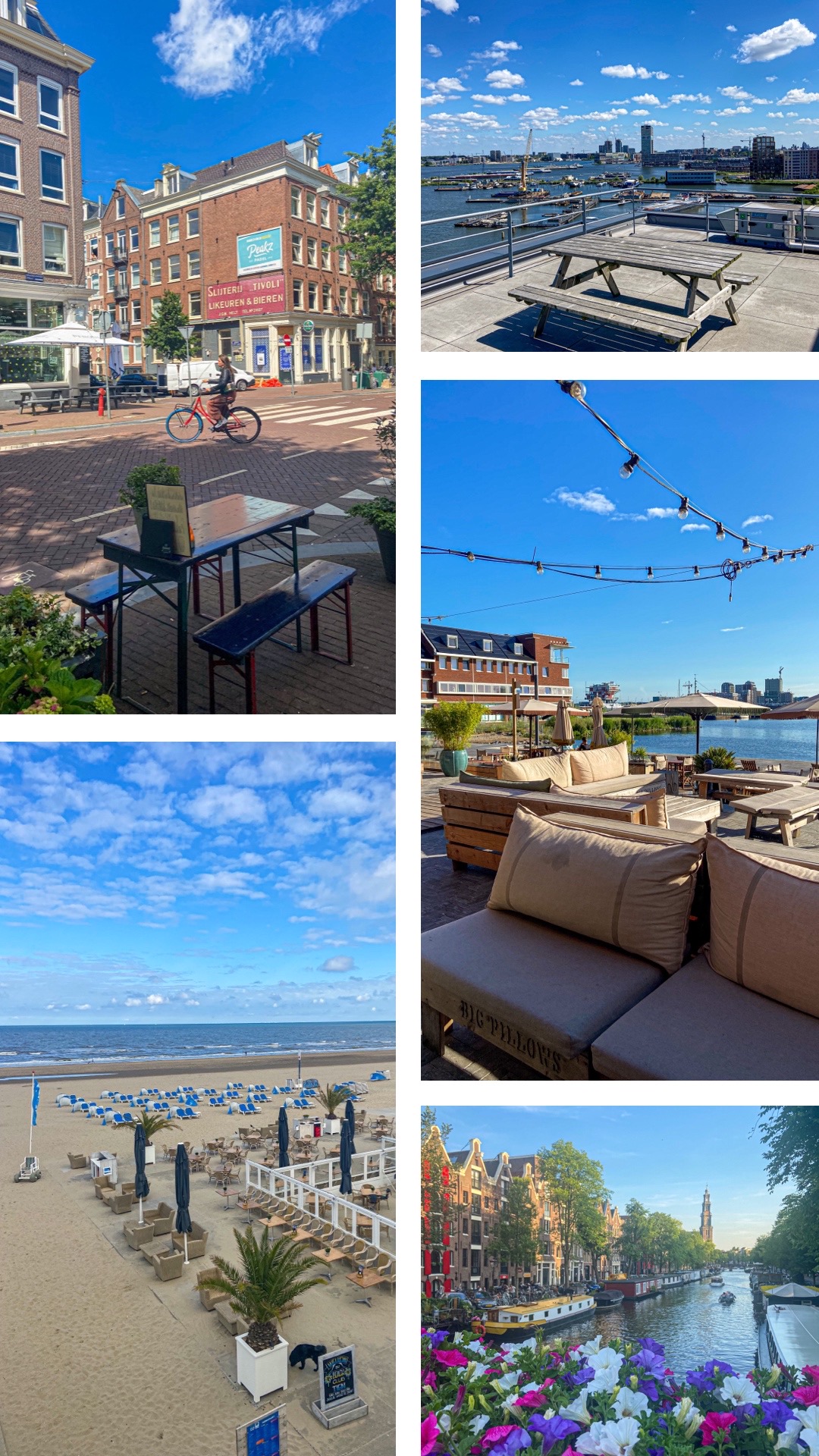

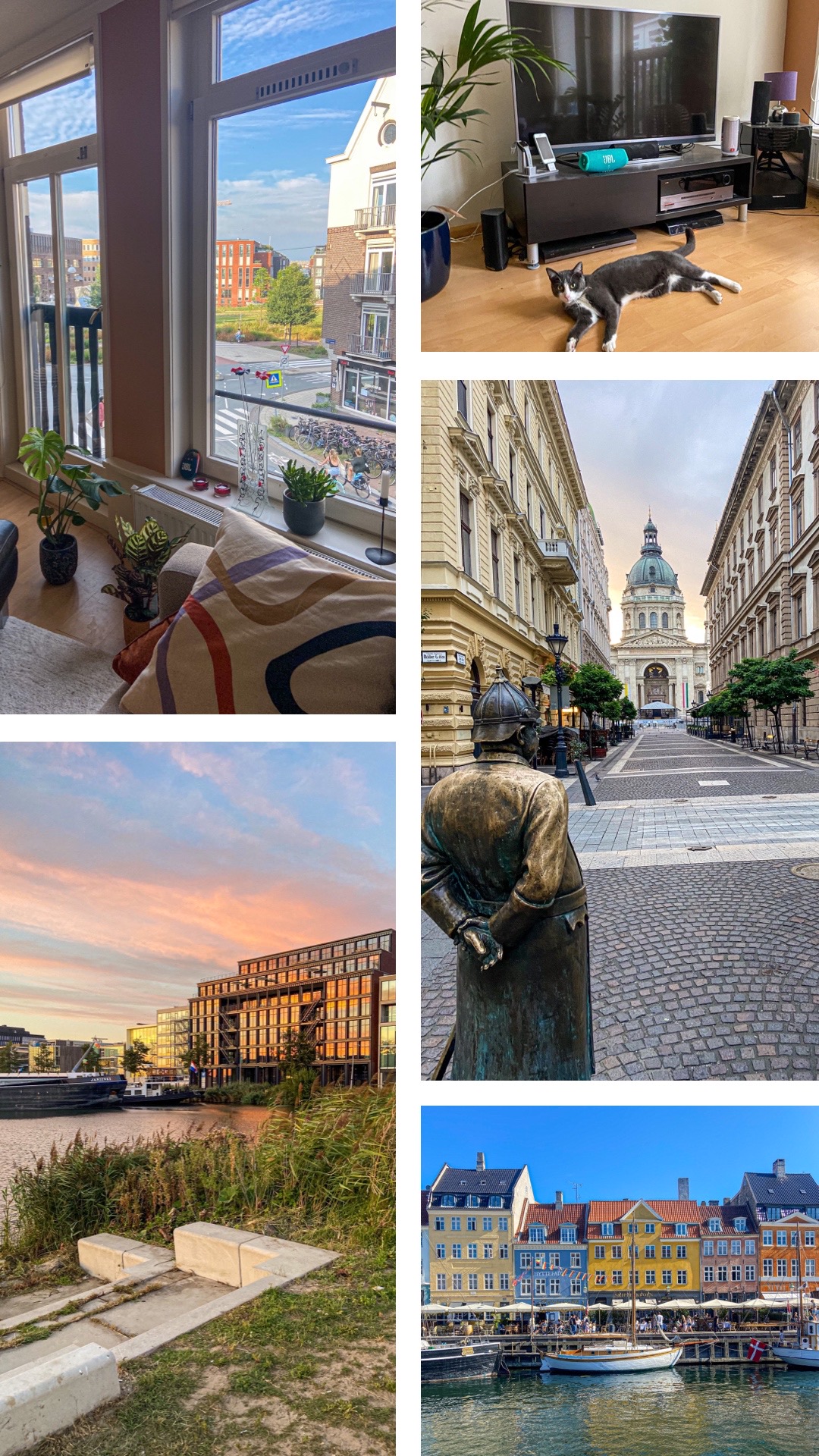

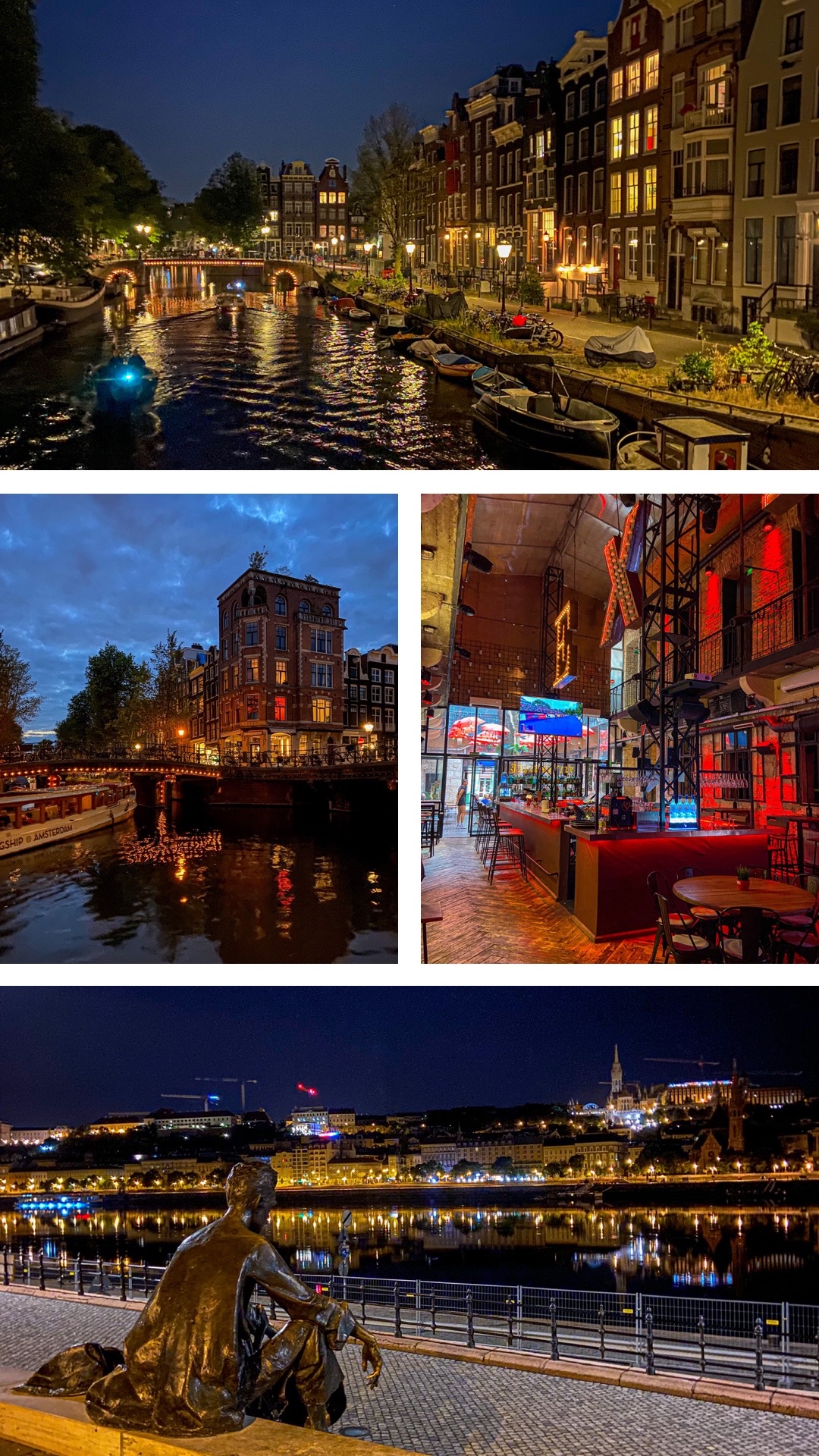

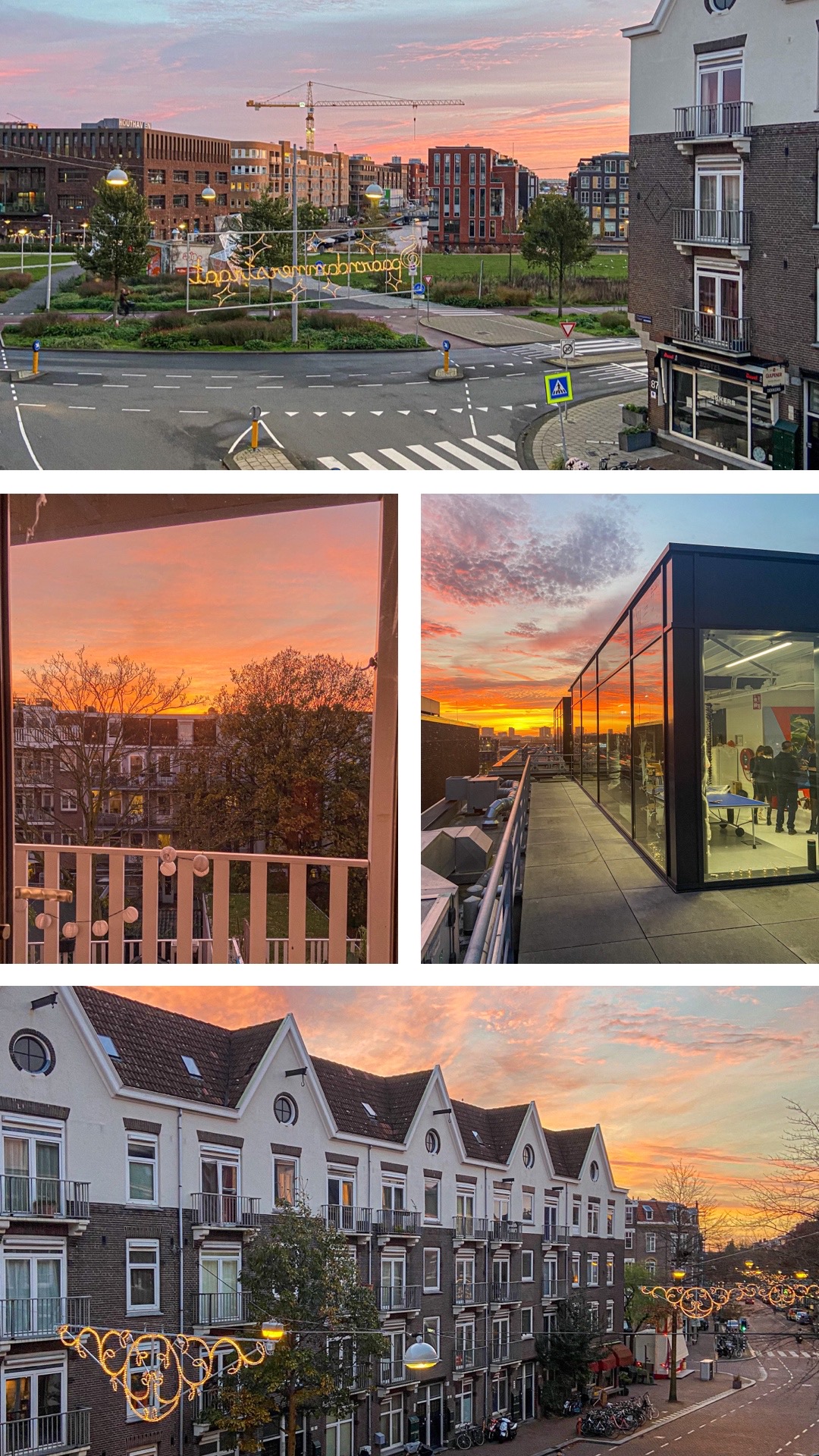

So here I am now: Marcus in Amsterdam – Season 1 (LINK). The sun is shining, sitting on the terrace of a boat hotel, overseeing the IJ river and Amsterdam harbour, having a Cappuchino and sourdough with scrambled eggs for breakfast, writing my blogpost. Feels like holiday. Who needs financial freedom when a workday feels like a holiday?

In these times we are just very privileged. This year a law in Netherlands gave more rights to employees who want to work from home or remotely. Before COVID this was the dream life. Now it became reality. Not everything that happened in the past few years was bad I guess. But also not everything went as expected this year.

Stained glass windows in my mind

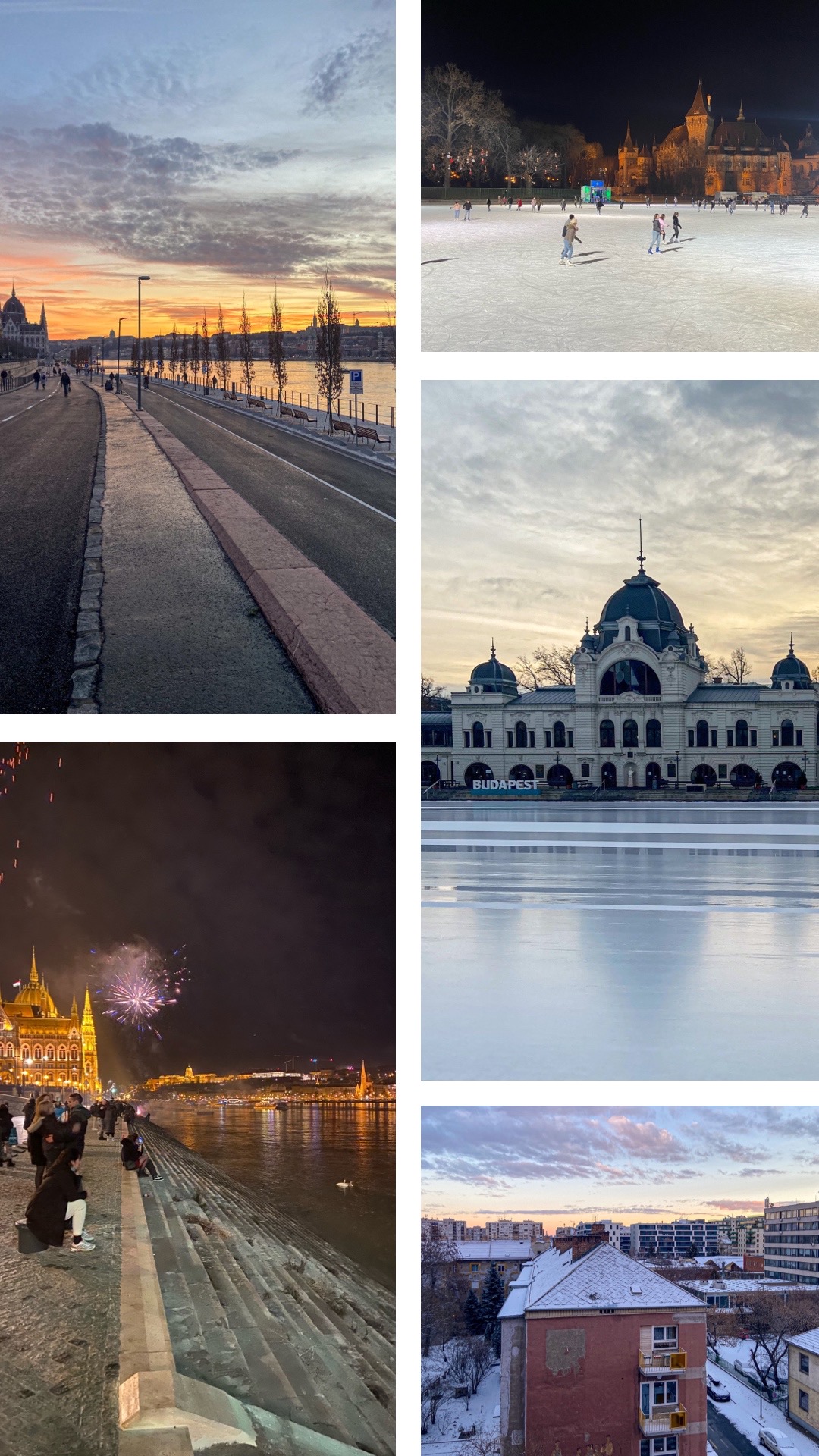

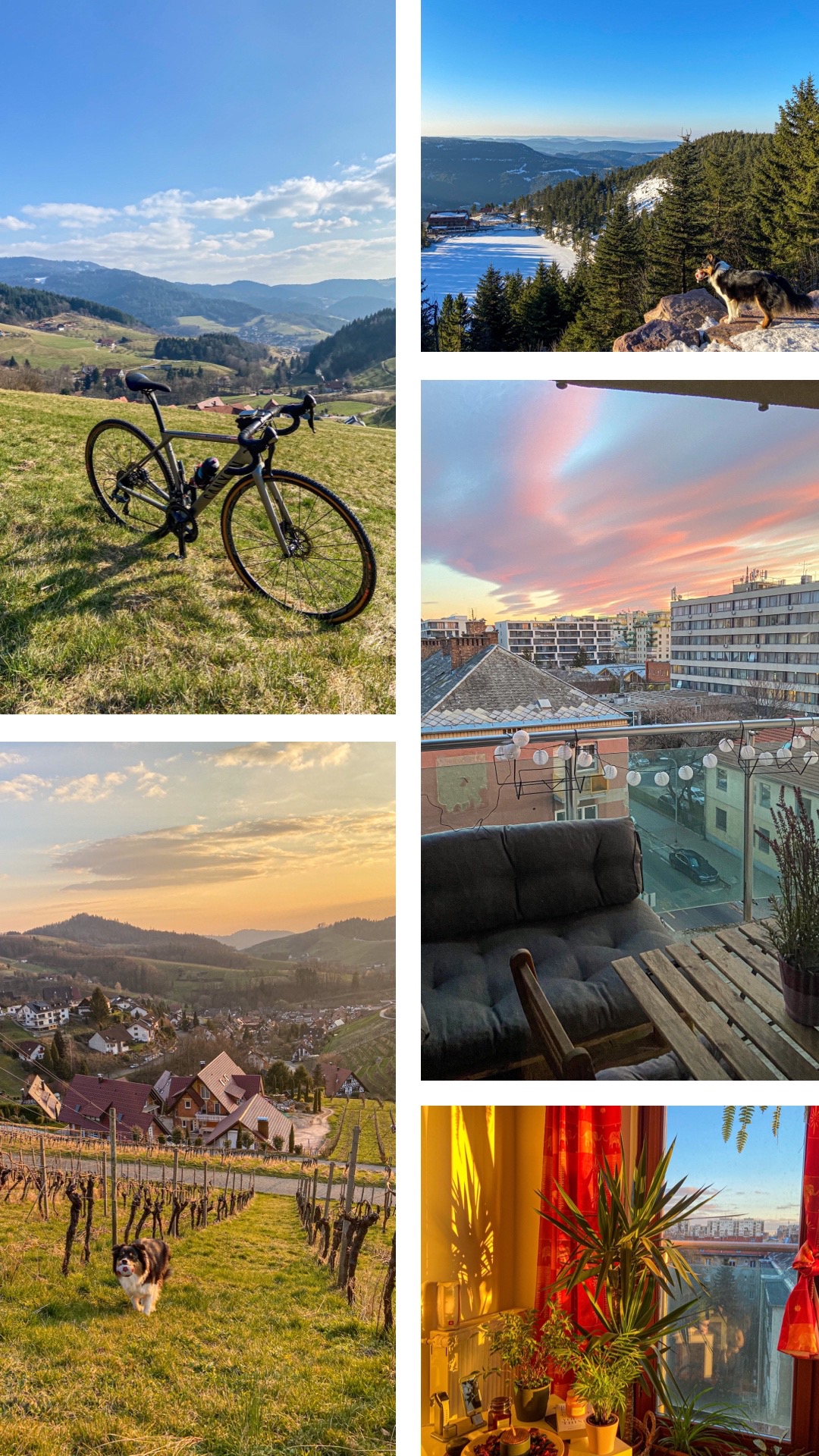

After most of the COVID restrictions lifted it was finally time to go back to normal. And my normal includes traveling. As soon as the mask requirements in airplanes dropped I started to book my first flight. Looking back at the year I`m amazed how much I was able to cover during the COVID aftermath year: Hungary, Croatia, Denmark, USA, Netherlands, Germany.

Nothing compared to my prior COVID times, but still a good list. And to this day I have never been tested positive for COVID. I`ll add this to my achievement list. Of course the additional travel and relocation impacted my savings rate a bit.

Breathe in, breathe deep, breath through, breathe out

Fortunately it was covered by a huge salary increase. The 30% ruling in the Netherlands allows expats to reduce income taxes and keep most of their gross salary. The application process is a bit complicated, but managable if supported by your company:

- first and foremost, the employee must be transferred or recruited from abroad;

- the employee works for an employer registered with the Dutch tax office and paying Dutch payroll tax;

- employer and employee have to agree in writing that the ruling is applicable;

- the employee did not reside within 150km from the Dutch border for the last 18 out of 24 months at the time of hiring;

- the employee’s salary meets the minimum requirements (€38,347 in 2020)

- the employee needs to have expertise that is scarcely available in the Netherlands.

The application takes a couple of months, once it is approved you get your tax reduction in retrospect from the date of application. Mine was approved in September, so I got three months of tax reductions, resulting in the funny scenario that my net salary in September was higher than my gross salary.

After all I take home around 5.000-5.500 EUR net per month (including vacation/13th month salary) which is triple the amount I had in Hungary and almost double the amount I had in Germany. Of course the rent is higher in Amsterdam than the areas I lived before, but I was able to maintain a savings rate around 50% for the second half of the year – so it is still a considerable amount I can put into investments each month.

Carnations you had thought were roses, that`s us

And it is a good market to invest in. Everything is on sale. The market went down heavily this year, one of the main reasons why I will not achieve my 100k goal for 2022. Almost all savings from the first half of this year got cannibalized by my unrealized investment losses. You only lose money if you sell. I took this market decline as opportunity to further increase my investment depot. Hopefully this will pay out in the next years.

Other negative factors this year were high inflation and worsening FX rates. In the first half of the year my salary just went down by month due to the Forint decline, in the second half the EUR/USD rate had a negative impact on my 100k USD goal. Now it is more like a 100k EUR goal.

Did you hear my covert narcissim I disguise as altruism like some kind of congressman

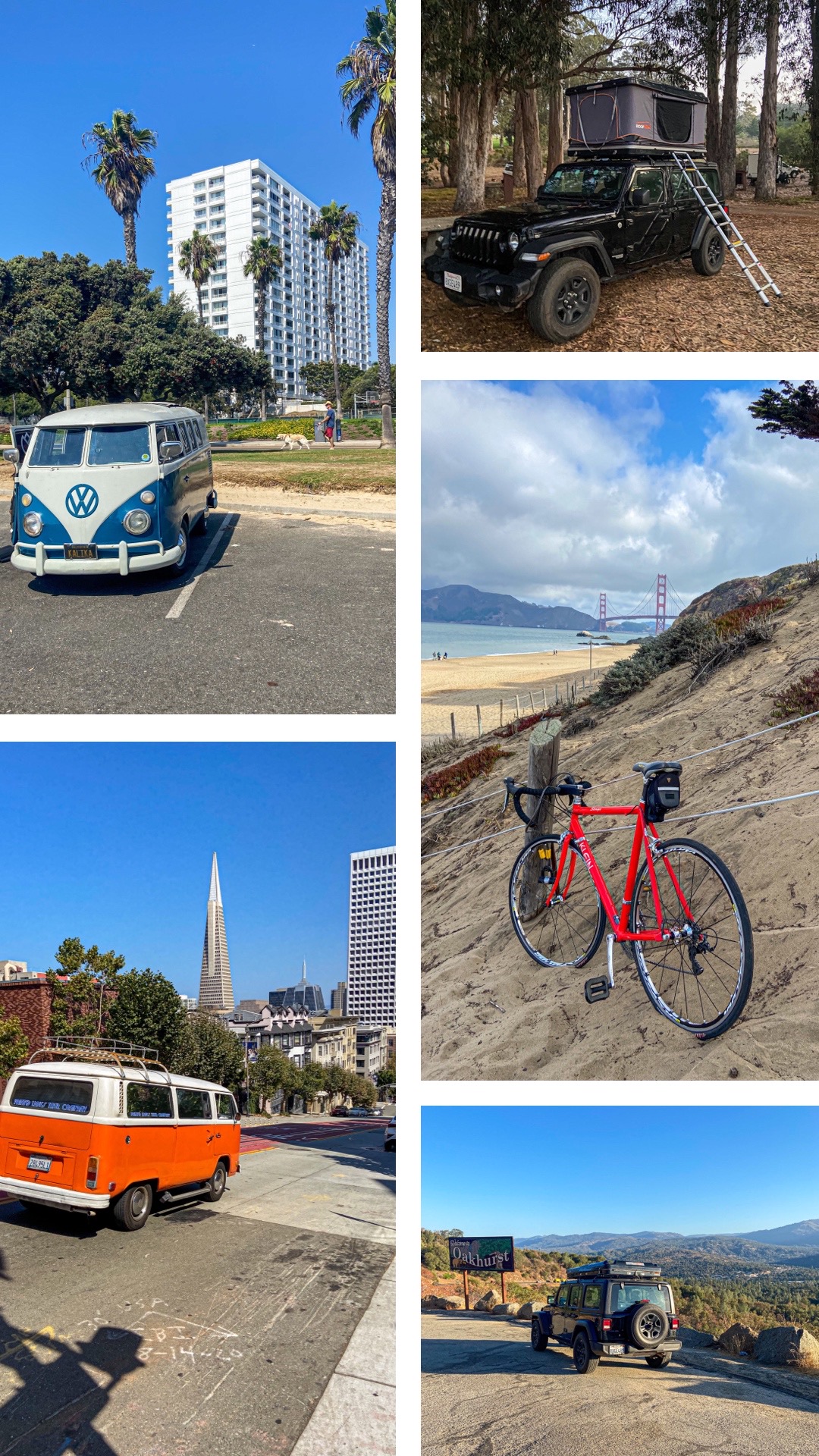

The biggest spend this year was my ten day US Trip in September. Even though I saved a ton of money by not staying in hotel rooms, the costs were around 3.000 EUR:

- Flights (AMS-NYC / NYC-SFA): 800

- Camper Van (six days): 800

- Fuel: 400

- Campsites: 200

- Food: 500

- Other: 300

I slept at a friends place, three times in an airplane, once at JFK airport, four times on top of my Jeep Wrangler and one night at a Marriott in Downtown Manhattan (which I payed by my Marriott Bonvoy points). So much for frugal travel. No clue how much money I would have spent if I`ve stayed ten nights in a hotel room. Probably twice as much.

Luckily most of the cost got covered by my relocation budget again. So it did not have that much of a negative impact on my net value. And the memories are invaluable anyway.

The rust that grew between telephones

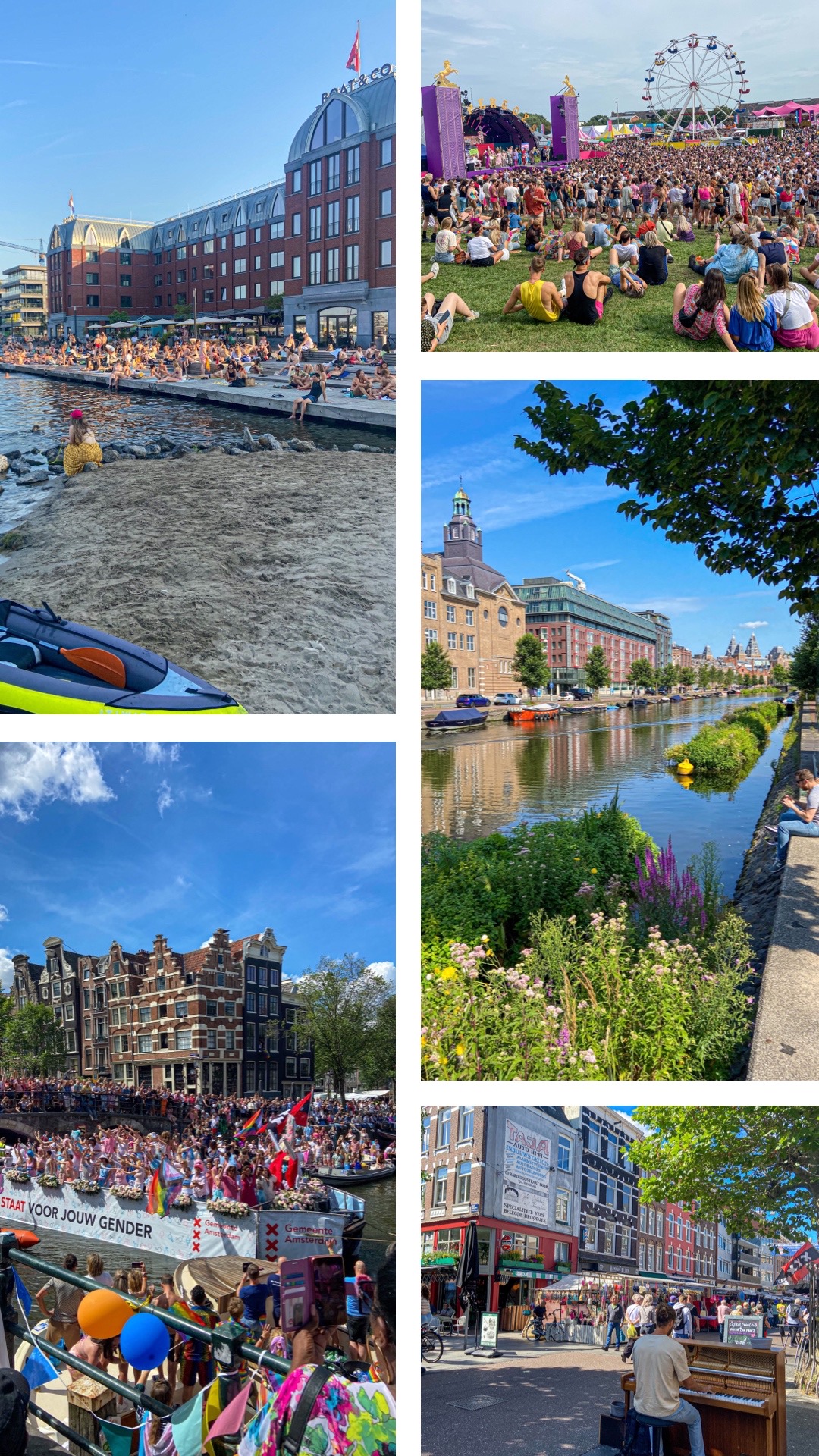

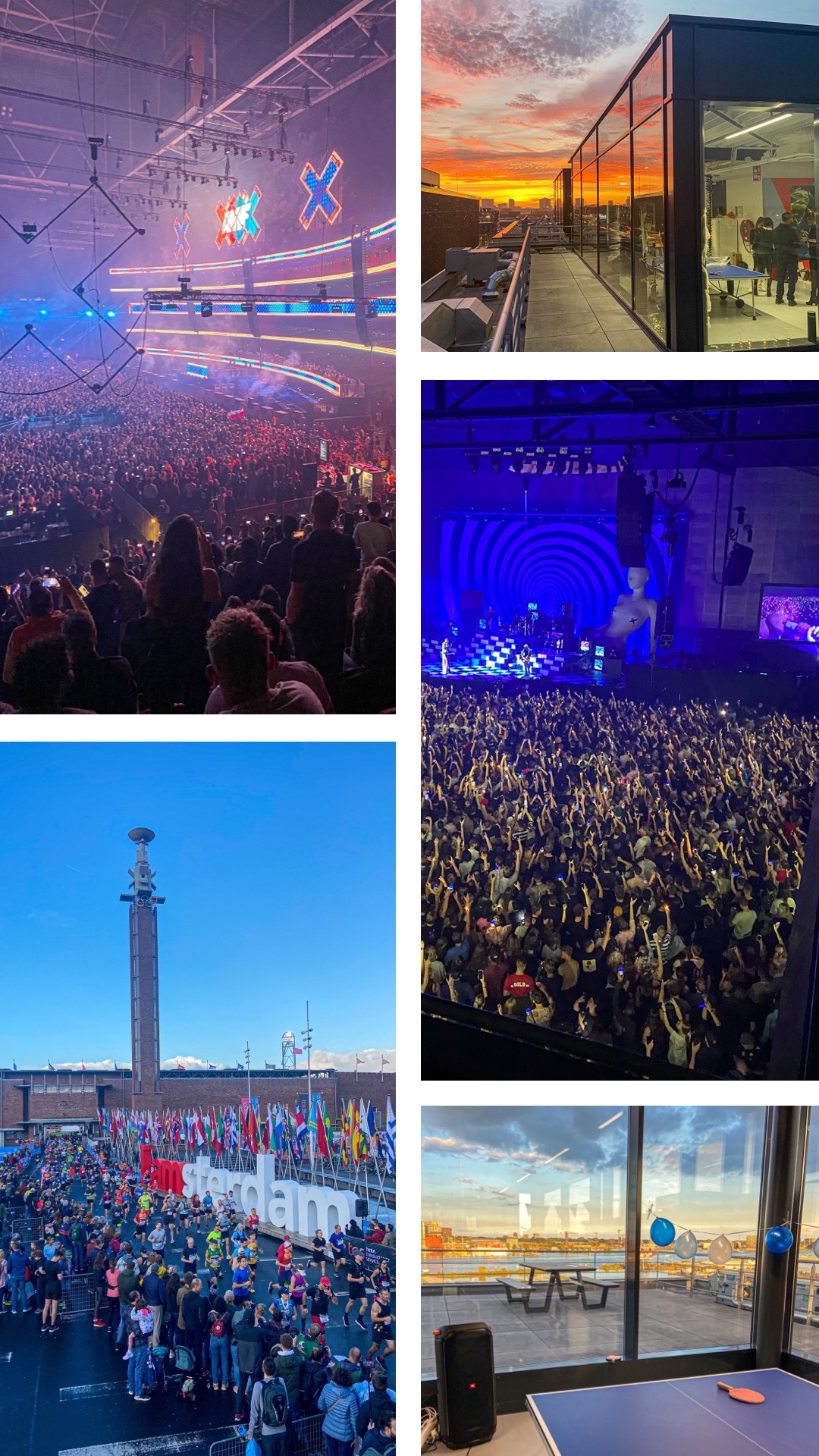

After the US trip I started to cut down on travel expenses. It got very quiet during that time. Keeping in touch with people who are not living in the same place as you are can be challenging. But I found another hobby. Amsterdam is the capital of music in Europe.

Hundreds of music festivals and every big band stops in Amsterdam during their tour. I finally got to see some of my favorite acts, including Machine Gun Kelly, Chainsmokers and Martin Garrix. Some of the savings from not traveling went into the concerts. But after all, I was still able to keep my savings rate around 50%. That`s when my net value starting to steadily increase again.

Everything you lose is a step you take

In November it got even more quiet. But sometimes you have to get rid of old things, mentalities and people to make room for better things to come into your life. Many bad thing happened this year, but looking back I gained a lot of strenght from these occurences.

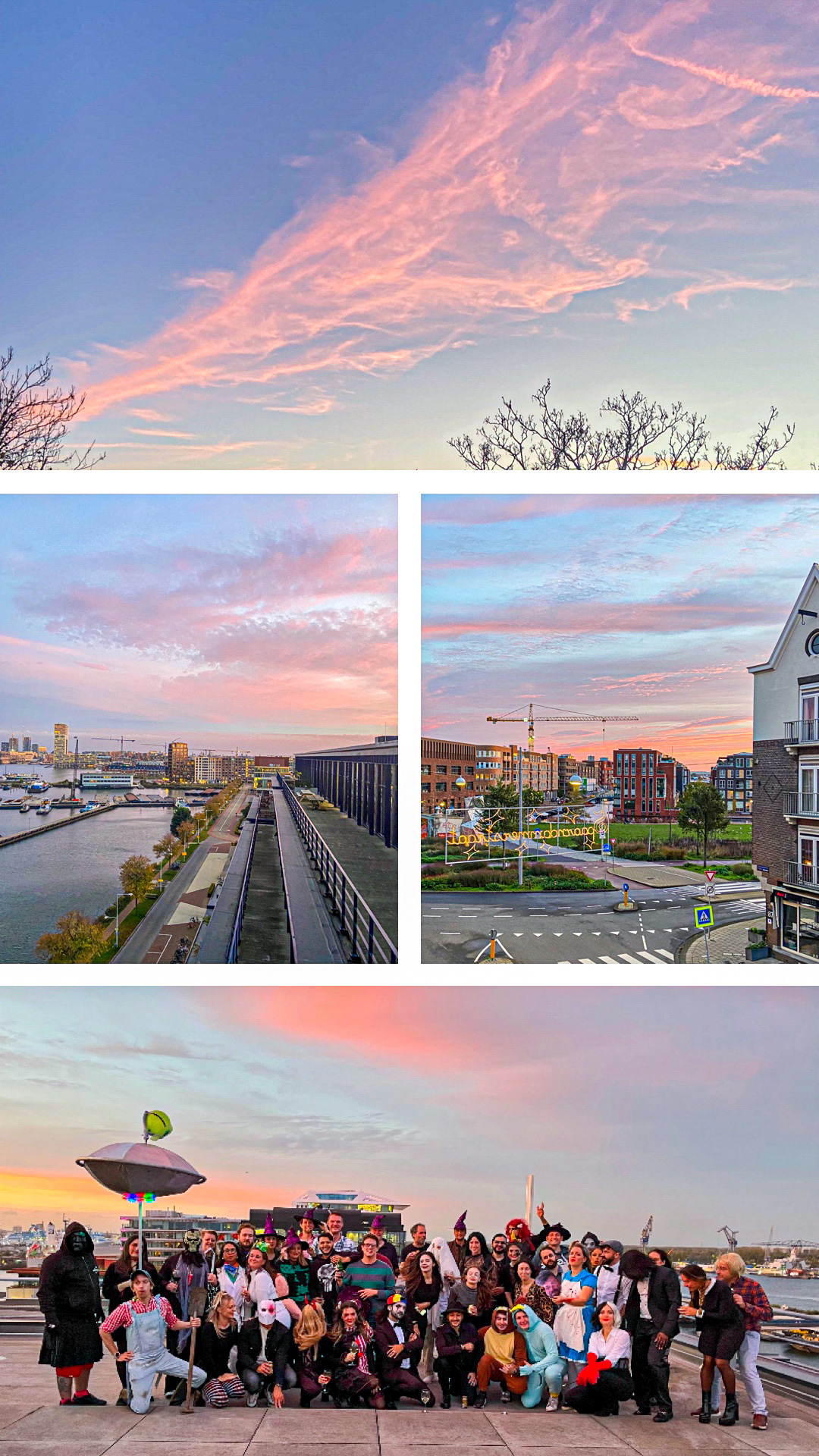

And everything I lost got replace but something more beautiful. From the great sunset at the Halloween party, over free lunches at the office, my amazing flat in Amsterdam to all the events and parties happened in the last quarter of this year. I don`t miss anything I lost during this journey.

Karma is a relaxing thought, aren`t you envious that for you it`s not?

Time to reflect. There is only one constant in life, and that is change. Evolve or repeat. Even though I did not reach my goal for this year, my ultimate goal came closer and I can look back on an amazing year. Just putting together my best-of pictures from this year for the annual highlight reel made me aware of how cool 2022 has been.

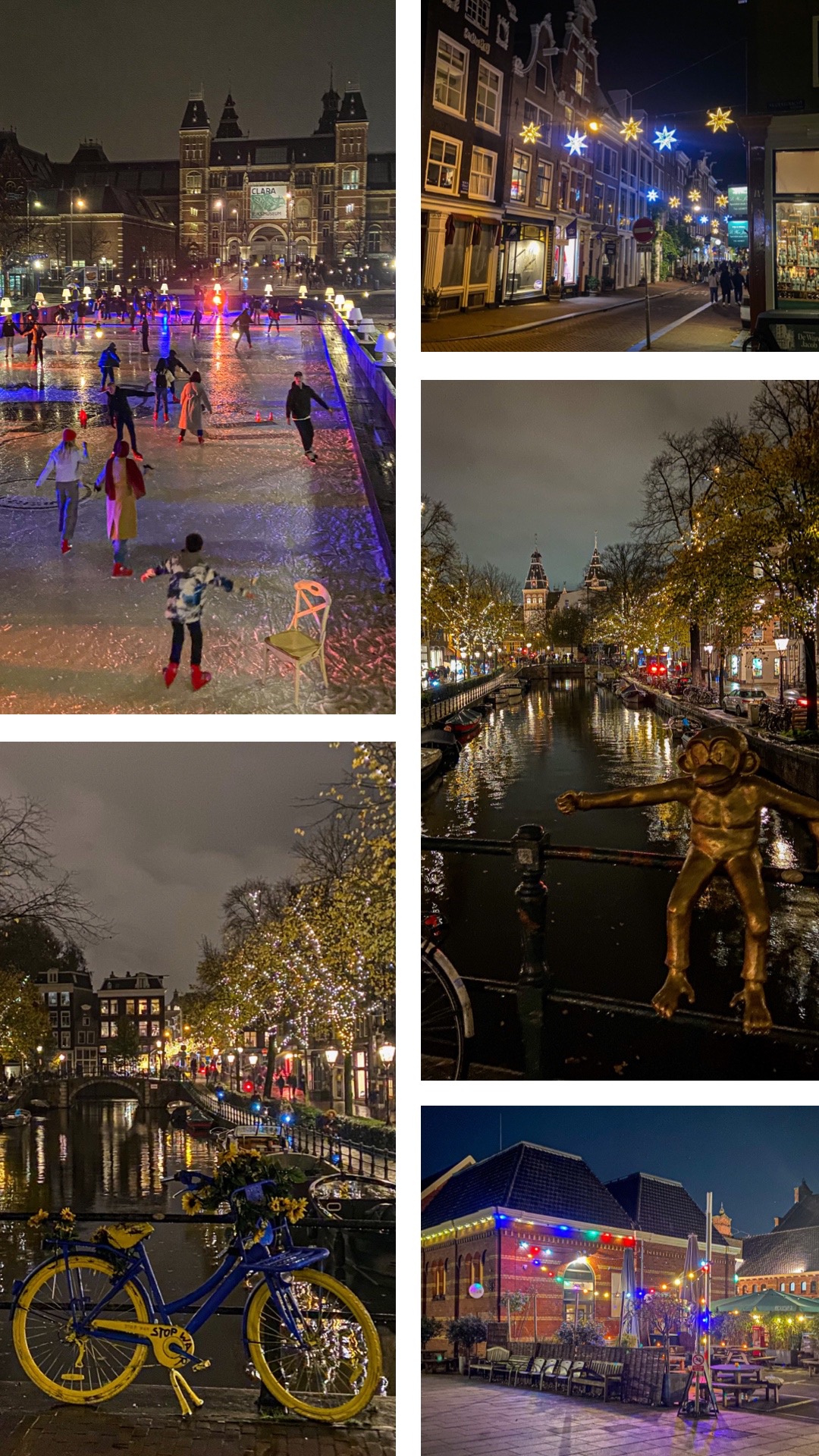

From fireworks at the Danube in January to the Amsterdam Light Festival in December. Looking back, it may have been the best year I ever had. And this journey all started with the FI movement. It was never about money or retiring early. It was always about living the best life now and removing everything that is impacting the quality of life. No matter if it is a soul sucking job, unsupportive people or expensive purchases which don`t add to your overall satisfaction and happiness.

Waking up in the morning with relaxing thoughts will always be a goal.

And I miss you, but I miss sparkling

So what is next? In 2023 I will definitely reach my first 100k investment and it may be time to take a step back and let my investments coast. My FI date came closer by two years again (2026). Do I really want to retire by 40? Have a million by 50? I`d rather enjoy my time now. Not working isn`t an option anyway. So the main focus will be to mold my work into something I fully enjoy. Keep moving around the world, no matter if long-term or short-term. And to start sparkling again.

There is still this one big goal I have on my list. Will I make it in 2023? See you in twelve months for the next annual recap: Year 4 – The pursuit of financial freedom (2023 The American Dream)

You`re on your own kid, you always have been…

Numbers

Annual saving rate: 54%

Increase depot: -6.9%

Increase savings: 10%

Increase net worth: 9%

Wins in 2022 (II):

Annual savings rate green zone (despite of travels and living expenses)

Increase in savings/net worth by 10%/9%

30% ruling (5 years), 5k net salary

Negative Effects in 2022 (II):

High Inflation

Global Crisis (China, Ukraine)

FX rate (HUF, USD)

Crypto and stock bear markets

Potential for future:

Income increase to adjust HCOL & passive income streams

Less expenses, higher savings rate

Higher portfolio value -> more returns from investments after recovery of markets

Other Highlights in 2022 (II):

Marcus in Amsterdam

Canal Pride & Festival Season

California Road Trip

Octoberfest & Halloween

Triple Xmas

Current forecast (savings rate 50%, ROI 5,34%):

Financial stability (6 months expenses saved): OK

Financial flexibility (2 years expenses saved): OK

Financial independence light (live from savings/returns for 5 years): OK

Coast Financial Independence (reach retirement savings w/o further saving): OK

Financial independence light (live from savings/returns for 10 years): OK

Financial independence light (live from savings/returns for 15 years): 2024 (t+1)

Financial independence (live from returns 25 y/pass. income, 4%): 2026 (t+3)