How to Find your WHY and enjoy the journey to FI

1. Introduction

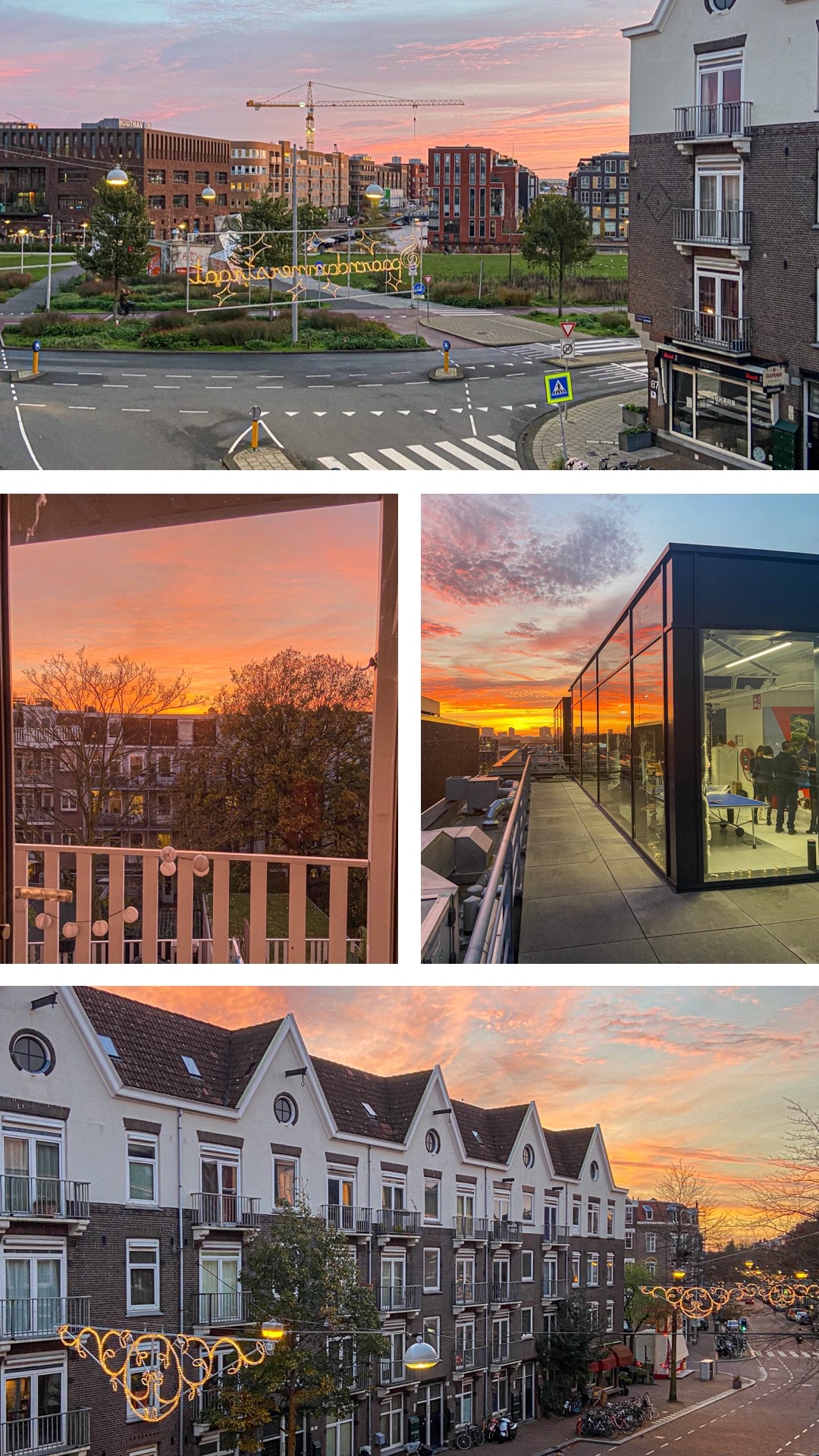

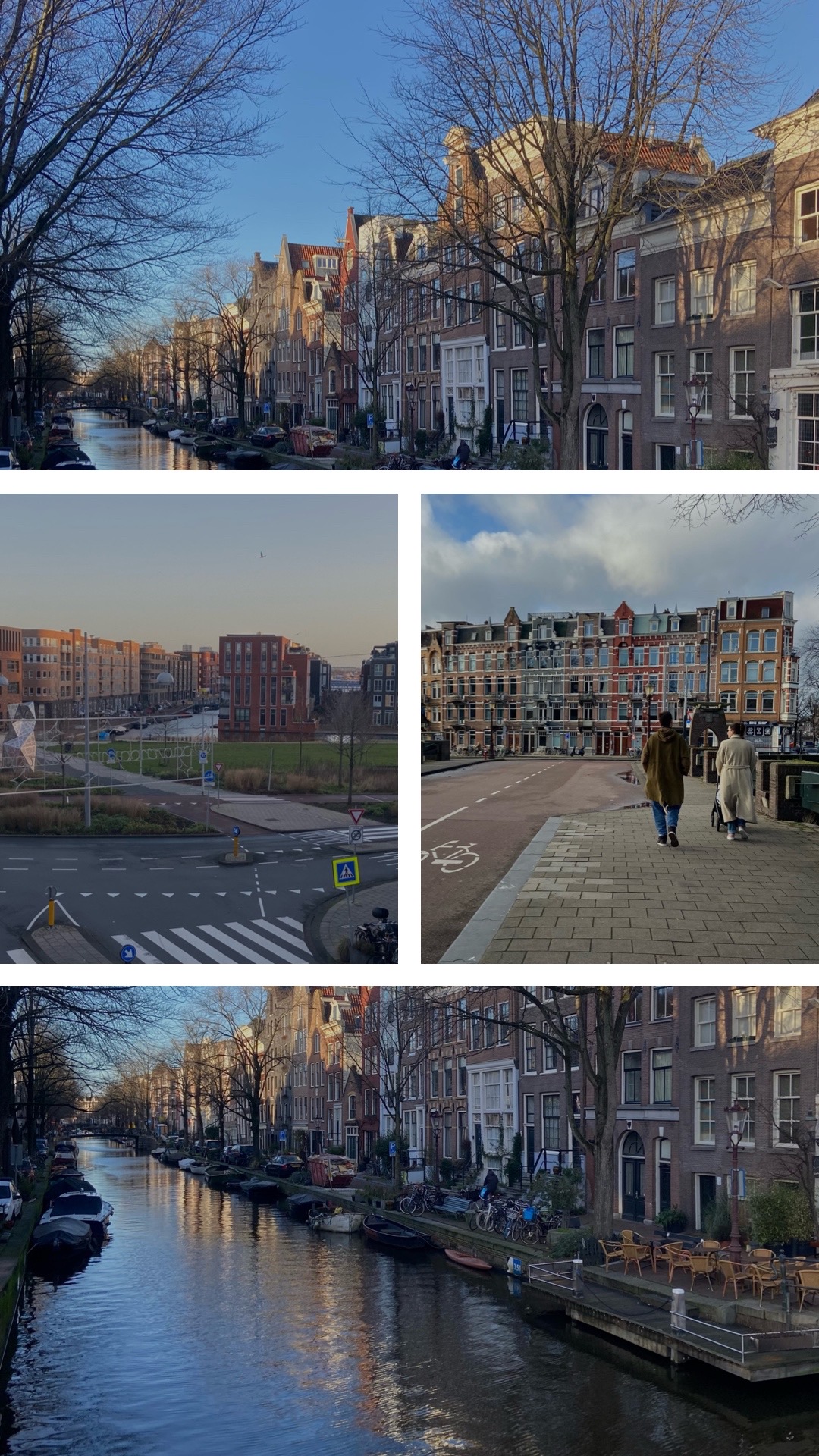

The sun is shining, sitting on the terrace of a boat hotel, overseeing the IJ river and Amsterdam harbour, having a Cappuccino and sourdough with scrambled eggs for breakfast, writing my blogpost. Feels like holiday. Who needs financial freedom when a workday feels like a holiday? In these times we are just very privileged. This year a law in Netherlands gave more rights to employees who want to work from home or remotely. Before COVID this was the dream life. Now it became reality.

But not everyone has the same privilege to live a life of free choice, independence and following their passion. Mental health issues are on the rise. Burnout, toxic work environment, living paycheck to paycheck, unfullfilling work, job insecurity & layoffs…just to name of few issues that come with being financially dependent on your employer. And big corporations are incrasingly taking advantage of this situation to drive their profits.

Why is it so important to be financially independent?

2. The Awakening

Everyone who is pursuing FI will have a different reason for it. But it all comes back to the same root cause – we are not living the life we would like to live. Not following our passion professionally. Not spending enough time with our family. Not having enough days off from work to travel the world. The anxiety of living paycheck by paycheck or losing your job.

FI is not about becoming a millionaire or retiring from work with 35:

„The whole thing isn`t really about money. It`s about living the right way, and money is just a facilitator to that.“

We are not born with the desire to become financially independent. Usually there is a triggering event. For me it was losing a job I loved during COVID in 2020. Even though I had heard about the FIRE movement before, it was this experience that made me long for more independence.

Not having the full control over my own future. One of my primary values is freedom. And in that moment I lost my freedom. I did not only lose my position. I also lost my passion and motivation. My work colleagues. My identity. My sense of safety. And my mental health.

And while I do not have control over all those factors, I realized I can at least control my financial safety net. That was the moment I started to get serious about FI. Cutting back unnecessary expenses. Starting to invest more. And using my already existing financial cushion to leverage my work into FIRExplorer. It was my awakening.

It can be a death of a relative, a car accident, depression, a layoff. There are many triggers that could be the final straw. Not every awakening has to be traumatic. Everyone’s story is different. But something needs to trigger the need in you to pursue financial independence. And this need is your WHY.

3. Find your Why

What is your Why?

Your why is not dependent on money. It requires time. But you can buy time with money. That`s why it is important to become financial independent. „Start with why“ from Simon Sinek is a great introduction into this concept. Not only for FI enthusiasts.

Being financially independent does not mean to never work again. But how cool is it, that you can chose what to do for work once you are not dependent on a salary anymore? You can follow your passion and write a book. Or cycle through the mountains every day. Become a career coach and help all the young people to avoid your own mistakes at work. Move to the beach and lie in the sun all day long reading. Or spread the FIRE!

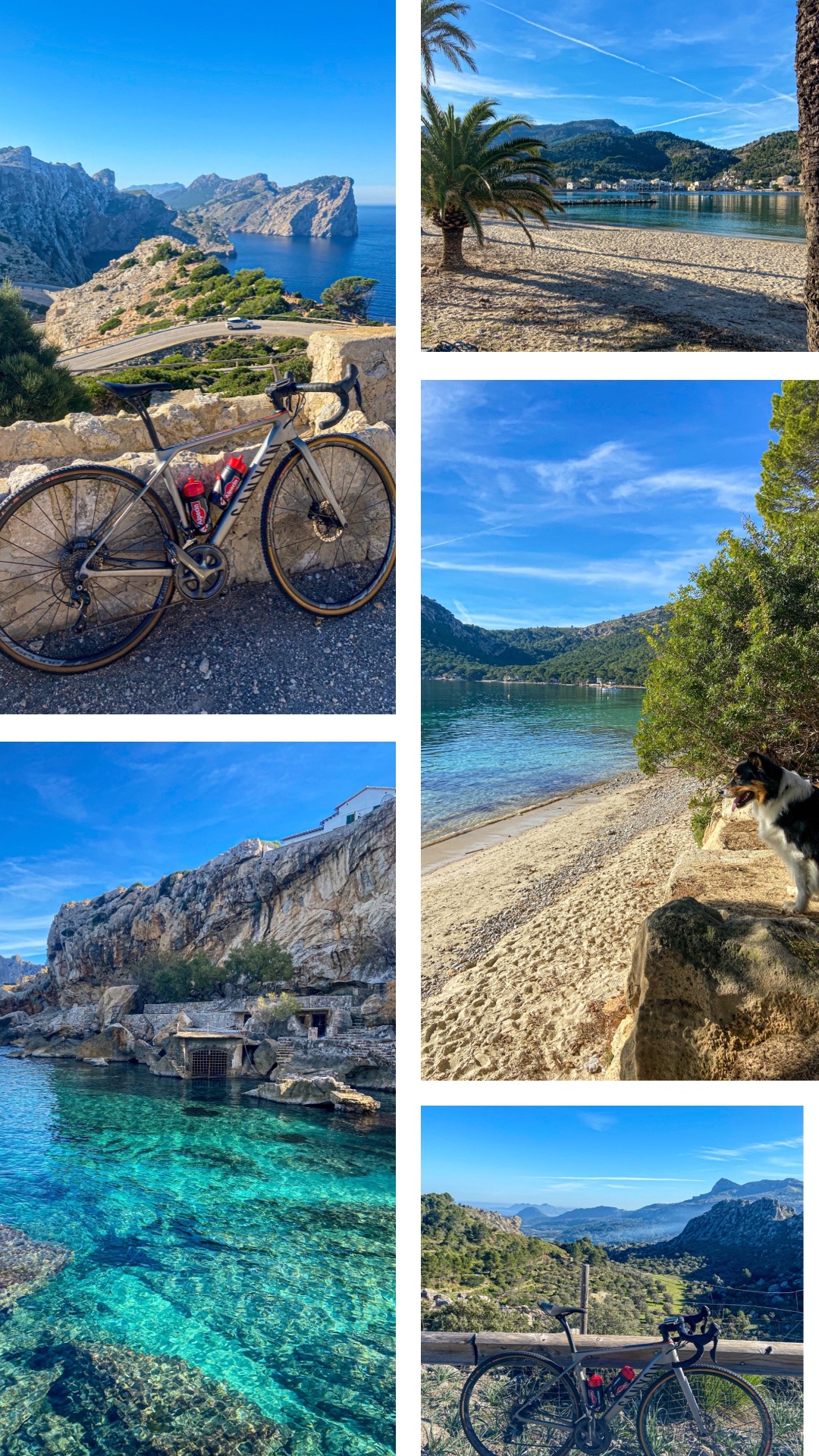

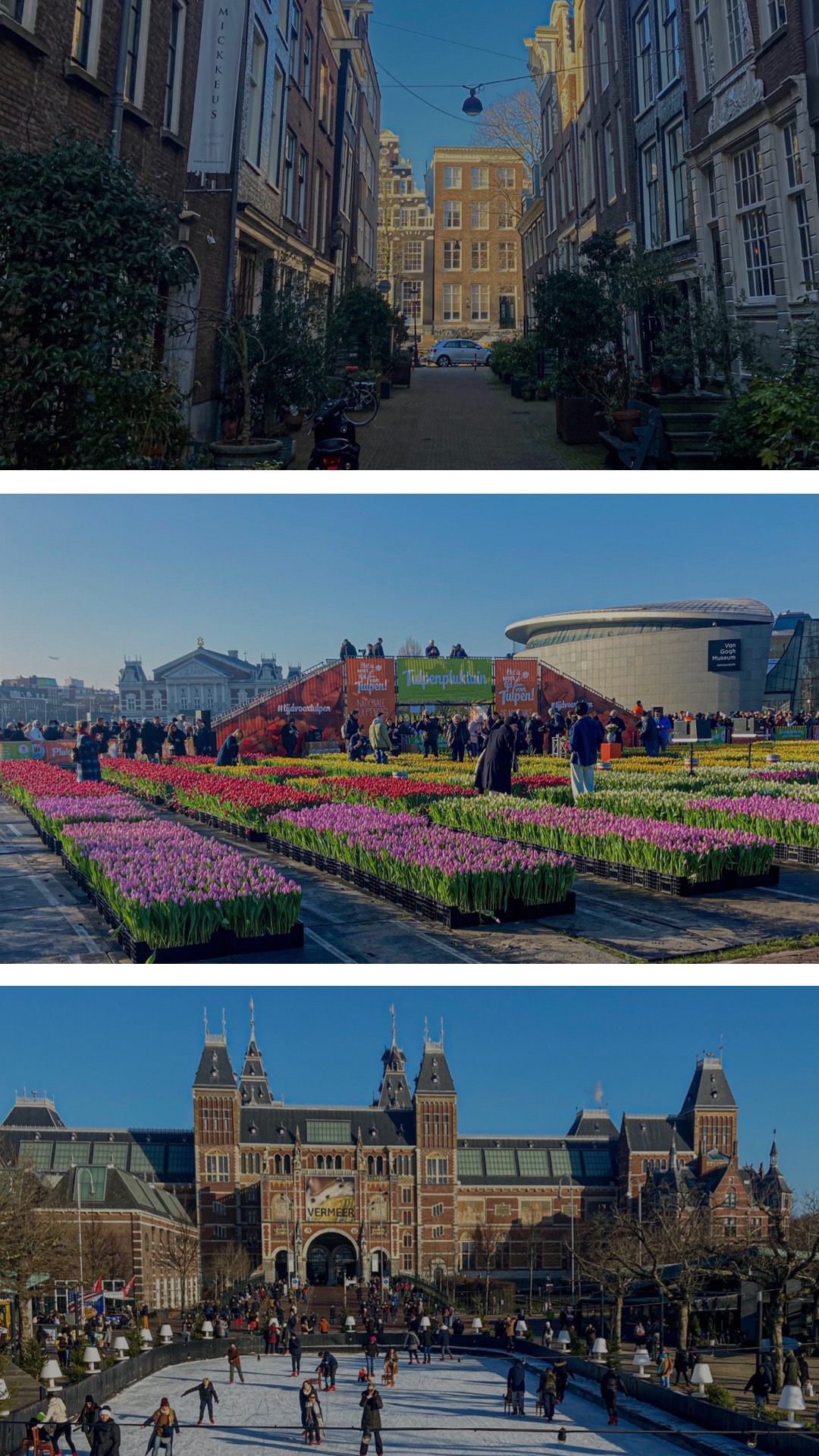

My Why is a Change. I hate being bored and need something new every day. So working in a repetitive job and doing the same work for years is my personal hell. But the same hell would be early retirement and not doing anything all day long. I need to learn. Travel somewhere I have never been. Start a side hustle. Practice a new skill. Get a dog. Move to Amsterdam. Write a blog. Manage a team. Cycle up a mountain. Start a band. Run around a lake. Lie at a beach on Bali. Hike to Santiago de Compostela. Go on a cruise. Fall in love. Listen to a podcast. Go back to university. Find new friends. Get my heart broken. Start a new job. Write a book…you get the drill.

To do all of this requires a lot of free time. And working 40 hours per week does not allow me enough time to follow all of my passions. So I needed to find a way to get rid of my 40 hour work week. That`s what sparkeled the FIRE in me.

So how do I find my Why?

4. The 10 Things List

One of my favorite playbooks on the FIRE movement is „Playing with FIRE“ from Scott Rieckens. It was one of the first books on FI I binge-read. Scott was fascinated by the movement, but he struggled with sparking the FIRE in his wife. So he came up with a wonderful idea: Write down a list of ten things you love most during your day. He made his wife and himself put together a list and soon both of them realized that their lists did not contain any activities that cost (a lot of) money.

Here`s what his wife wrote down:

- Read my baby a book

- Listen to my baby laugh

- Have coffee with my husband

- Have a glass of wine at night

- Eat delicious chocolate

- Ride bikes with our family

- Go for a walk

- Spend time with our parents and our family

And here is a list I wrote down for myself in 2021:

- Sitting on the balcony in the sun

- Riding my bicycle

- Listening to my favorite music

- Reading a good book

- Talking to colleagues at work

- Eat tasty food and drink coffee in a cofeeshop

- Taking photos

- Writing for my blog or writing in general

- Playing with my dog

- Have people I like around me

Not many activities on those lists require money. All of those are location independent. So if those are our favorite activities, then why do we need to earn a high salary, work hundreds hours per week or live in the fanciest place of the world? Right, because society defines it with success. Your why is what makes you happy. Not what society tells you you need, to be happy.

So put together your list and keep it by your side. Remember to look at it from time to time. For example when you are planning to buy your next car or book the vacation to the Maldives.

I`m pretty sure I have found my Why – so how do I start?

5. The Right Mindset

We will get to the financial basics in Part 3 of the FI Series. But for now, let`s start with the foundation.

When setting yourself a goal it is important to keep in mind the finish line. You know your Why. But what if it turns out your Why changed or was not what makes you happy?

„FI is not about running away from the things you hate in life. It`s about running towards something“

You would not be the first one to achieve financial independence just to realize it did not make you happy at all. How to avoid this? Based on your why you have to consistently create your life after FI.

How do I create my life after FI? One important factor in this process is your mindset. Mindset – the simple title of Carol Dwecks book: Growth mindset vs. Fixed mindset:

Someone with a growth mindset views intelligence, abilities, and talents as learnable and capable of improvement through effort. On the other hand, someone with a fixed mindset views those same traits as inherently stable and unchangeable over time.

For example, as an aspiring entrepreneur, you need basic finance skills to create your business’s budget and prepare its financial statements. If you have a fixed mindset, you may think, “I’ve never been good with math, let alone financial statements. I’m not cut out to run my own business.”

Now imagine you approach the situation with a growth mindset. You might think, “I don’t have a background in finance, but I can learn and practice those skills until I feel capable.” (Source)

A growth mindset will help you create a life around your Why that you can enjoy and even monetize. Being employed and following instructions from your employer is easy. Being your own boss is more challenging. Setting up a blog around your passion project. Writing a book that sells. Hosting a conference for hundreds of people. Creating value out of your side hustle. Managing your finances day to day. All of these skills are not taught in school or university. We have to learn those by and for ourselves.

And the basic for continuous learning is: A growth mindset. So to be successful and happy in your life after FI, one of your biggest competitive advantages is a growth mindset (it is an advantage during your classic 9-5 too). So I encourage you to practice a growth mindset and foster it on your journey to FI.

6. The Detachment List

Another tool I would like to add to your foundation is: The Detachment-List.

For starters, name ten things or activities in your life that you are afraid of losing the most. Which you could not live without. Don`t just name the person you are afraid of losing. Name an activity or feeling you connect with that person. For example, don`t say: I would be afraid to lose my spouse or my kids. Say: I would be afraid to lose drinking coffee with my spouse in the morning. Or: I would be afraid not being able to read my kids goodnight in the evening anymore.

Your list could look like this:

- Reading my son goodnight in the evening

- Riding my bike on sunny weekends

- Going for a walk with my dog every morning

- Spending one week per year doing roadtrips through the states

- The feeling of waking up in my own flat

- …..

And then imagine you lose everything on that list. How would your life look like? How would you feel? Scary, right? I have a bad news for you. You will lose everything on that list one day. There is no way out. You can lie in bed, cry and grief your loss. Or you can move on and find a way to replace what you lost.

And soon you will discover – everything you lost got replace by somerthing new. Maybe even better. Kids are too old to read them goodnight every evening. They are spending the nights out partying with their friends now. But, you get to go the their sports events and celebrate their basketball championship together. Getting them a scholarship for a great college.

And suddenly your list looks like this:

- Watching my son win a game at basketball

- Sitting on the balcony of our house on sunny weekends

- Seeing our daughter play with the new puppy Labradoodle

- Watching the kids learn swimming at the beach in Spain

- The feeling of waking up in the morning and not having to work for money anymore

- …..

What I`m trying to explain is, no matter how tight you hold on to something, you will lose it one day. But many times it gets replaced by something good or even better than before.

So take a look at your Detachment List.

Is there something on your list that you are holding onto, even though you may feel better if you would release it? Detach from it? Something that was great once, but now mostly brings you anxiety and fear of losing it? Try to free yourself from it. It does not mean get rid of it. It means get rid of the fear of losing it. And let the universe decide once it is time for you to lose it and replace it with something more beautiful.

On your way to FI you will lose a lot of material things and relationships. But as Taylor Swift goes: „Everything you lose is a step you take“

7. Enjoy the Journey

Last but not least – this is the most important chapter in the process. Your Why is based on living the best life and enjoying your time as much as possible. Don`t fall into the trap of being miserable on the journey to FI. Just to realize you are still miserable after achieving FI. Create a journey to FI that balances your savings with the quality of your life. And take a step back to enjoy the journey. (The FI Series – Part I: Stages of FI & FIRE Concept(s))

It is the reason I`m exploring a Slow FI approach. I could reach financial freedom within a couple of years by sitting at home, saving & investing all my income. But what if in a couple of years I regret losing all this lifetime? Remember, more spare time is part of my Why. So why would I waste all of my time sitting at home saving? Isn`t that the opposite of my Why?

Slow FI means taking the relaxed road to FI (Slow FI – When FOMO meets YOLO). Still saving & investing a portion of your income, but using parts of it to improve life in the Now. For example, for me this is traveling internationally at least once per month. Buying a new road bike, even though I already own four. Going out to a restaurant and having expensive dinner from time to time. I do not have to spend this money, but I like to.

Even better! You can use the partial freedom that the journey to FI brings and leverage it to improve your life, long before achieving your FI number. Getting rid of your soul-sucking job for one that pays less but allows your more clarity and time to spend on your Why. Improving your mental health by traveling to a warm place during dark winter months. Or just buying something that makes you happy.

Since I started my FI journey in 2020 I have been documenting all the changes FIRE brought to my life:

- The pursuit of Financial Freedom – Year 1 (2020 – The COVID awakening)

- The pursuit of financial freedom – Year 2 (2021 – The COVID Aftermath)

- The pursuit of financial freedom – Year 3 (2022(I) – The First 100k)

- The pursuit of financial freedom – Year 3 (2022 (II) After the Storm)

And I can tell you, I`m having so much fun on this Slow FI approach that I don`t even think about my final FI number anymore. This is your friendly reminder that you can live your Why already now – your reminder to enjoy the journey to FI!

The FI Series:

- Part I – Stages of FI & FIRE Concept(s)

- Part II – WHY FI (How to Find your WHY and enjoy the journey to FI)

- Part III – Focus Point: Expenses (Spend less)

- Part IV – Focus Point: Income (Earn More)

- Part V – Focus Point: Passive Income (Invest)

- Part VI – Redefine Retirement aka Fully Funded Lifestyle Changes (Choose FI)

- Part VII – Other FI concepts in a nutshell (4% rule, compound interest, Mini-Retirement, Geo-Arbitrage, EU vs. US FIRE)

- Part VIII – The Best Books & Blogs on FIRE

- Part IX – FIRExplorer (Fight the Corpiarchy and leverage your job to Financial Freedom)